Compound Interest Calculator

Calculation Results

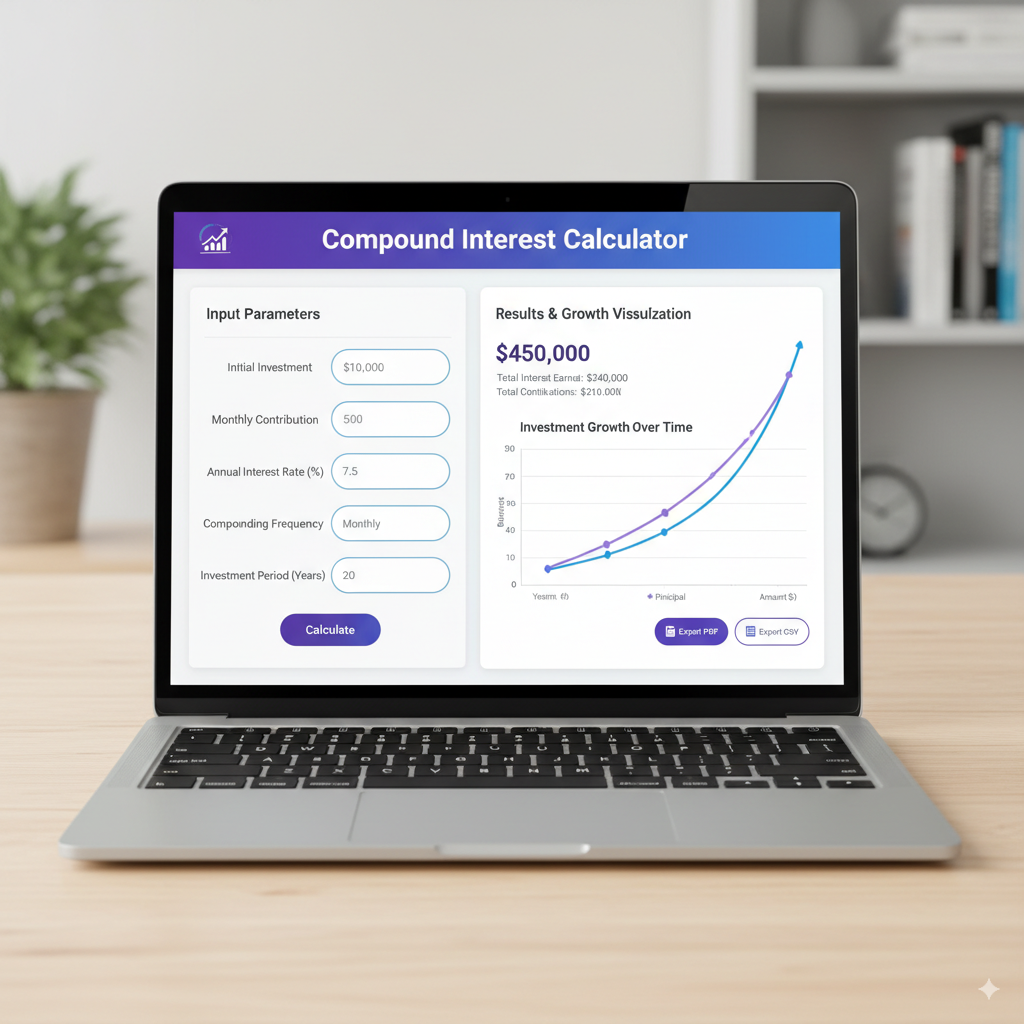

Money really starts to grow when you invest it thoughtfully, but the true magic in building wealth comes from the power of compounding. A compound interest calculator is one of the easiest yet most effective tools out there, helping you visualize just how your savings can multiply over the years. No matter if you’re a student dipping your toes into finance, a working professional eyeing retirement, or simply someone wondering about how your savings might expand, getting a handle on compound interest is essential.

In this guide, we’ll cover it all—from figuring out compound interest in Excel to exploring calculators for daily, monthly, weekly, and yearly compounding. You’ll also get insights into tools that factor in withdrawals and various what-if scenarios, so you can map out your financial path with real precision.

What is a Compound Interest Calculator?

A compound interest calculator is basically a handy digital gadget that shows you how your money builds up when interest gets tacked on not only to your initial amount but also to all the interest you’ve already earned. This is different from simple interest, which only pays out on the original sum you put in—compound interest just keeps building on itself, like a snowball effect.

Picture a snowball tumbling down a snowy hill: the longer it goes, the bigger and faster it gets. Your money does something similar under compounding—the more time it has to work, the more impressive your wealth becomes.

The calculator simplifies everything by crunching the compound interest formula for you:

A=P×(1+rn)n×t A = P \times \left(1 + \frac{r}{n}\right)^{n \times t} A=P×(1+nr)n×t

Where:

- A = The final amount you’ll end up with

- P = Your starting principal amount

- r = The annual interest rate (as a decimal)

- n = How many times interest gets compounded each year

- t = The time span in years

Rather than wrestling with the numbers on your own, the calculator spits out instant results and lets you play around with options like daily compounding, pulling out money along the way, or adding regular deposits.

Compounding Interest Calculator vs. Simple Interest Tools

A compounding interest calculator stands apart from a simple interest one because it doesn’t stop at just applying the rate to your original investment—it folds those earnings right back in to generate even more.

For instance:

- Drop $1,000 into a simple interest setup at 10% for 3 years, and you pocket $300.

- Switch to compound interest with annual compounding, though, and you’re looking at around $1,331— that’s over $300 more in growth, all without lifting a finger.

That gap widens hugely as time stretches on and compounding happens more often. It’s no wonder that investors, banks, and financial advisors lean so much on these compounded interest calculators.

Compounded Interest Calculator: Why Frequency Matters

When folks talk about a compounded interest calculator, they’re getting at how often that compounding kicks in. It could be daily, monthly, quarterly, or just once a year.

The key point? More frequent compounding means your money picks up speed quicker. Here’s a quick rundown:

- Annually: Interest drops in once every 12 months.

- Quarterly: It happens four times a year.

- Monthly: Twelve rounds in a year.

- Daily: A whopping 365 times.

Sure, the edge might feel tiny in a single year, but let it run for decades, and daily compounding could mean thousands extra over something annual.

Interest Compound Calculator: A Tool for Better Planning

An interest compound calculator is your go-to for forecasting what happens with savings, investments, or even loans. Curious about socking away $200 a month for a decade at 6% interest? Or how quickly unpaid credit card debt might balloon? This tool lays it all out, whether you’re watching wealth stack up or debt creep higher.

By tweaking the inputs, you can zero in on smarter moves:

- Boost those monthly additions

- Hunt for accounts with better rates

- Steer clear of debts that compound quickly

Using Excel to Calculate Compound Interest

If spreadsheets are your thing, you can totally handle compound interest calculations in Excel with its ready-made formulas. What makes Excel shine is how it lets you tailor your forecasts way beyond basic calculators.

Take this straightforward formula, for example:

text

CollapseWrap

Copy

=Principal*(1+Rate/Compounds)^(Compounds*Time)

Or, for scenarios with ongoing monthly deposits, try the FV function:

text

CollapseWrap

Copy

=FV(rate, nper, pmt, pv, type)

- rate = The interest rate for each period

- nper = Total periods you’ll have

- pmt = The payment amount per period (say, your monthly deposit)

- pv = Present value, or your initial sum

- type = 0 for payments at the end of the period, 1 if at the start

This turns Excel into more than a simple calculator—it’s a powerhouse for financial modeling.

Daily Compound Interest Calculator

A daily compound interest calculator lets you see growth when interest gets added every day. Not every bank does this, but it’s pretty standard for savings accounts and credit cards.

Say you park $10,000 at 5% annual interest with daily compounding—it edges out a bit over monthly compounding. That’s the daily interest stacking up relentlessly, pushing your balance higher faster.

These calculators are a boon for short-term savers or anyone shopping around for the best savings options.

Monthly Compound Interest Calculator

Since so many banks and lenders work on a monthly cycle, the monthly compound interest calculator is the go-to for most people.

Picture this: You’re dropping $500 each month into a savings account earning 7% annually, compounded monthly. After 10 years, you’ll see a bigger haul than if it compounded just once a year.

It’s also great for mapping out loans, as mortgages and credit cards often tick monthly.

Weekly Compound Interest Calculator

Weekly compounding isn’t as widespread, but some banks and investment options do use it. A weekly compound interest calculator figures growth based on 52 compoundings a year.

It sits nicely between daily and monthly, making it useful if you’re pitting different financial products against each other to spot the best compounding setup for you.

Annual / Yearly Compound Interest Calculator

The annual compound interest calculator, or yearly one, keeps things straightforward by adding interest just once a year.

It won’t ramp up your money quite like more frequent options, but it’s simple to follow and fits well with long-haul investments such as bonds. For anyone who prefers less fuss in the numbers, it offers clear insights without the extra layers.

Compound Interest Calculator with Withdrawals

Life doesn’t always let savings sit idle—you might need to dip in for things like school fees or retirement draws. That’s where a compound interest calculator with withdrawals comes in handy.

You can plug in your expected pullouts, and it still projects how your account evolves. Compounding keeps chugging along even then, so your balance holds stronger than it would with plain simple interest.

This is a must-have for retirement setups, where regular withdrawals are the norm but you want your nest egg to endure.

Compounded Monthly Interest Calculator

For folks eyeing credit cards, personal loans, or home mortgages, a compounded monthly interest calculator is a real eye-opener. These products typically compound every month, so grasping the true growth or cost is crucial.

A tiny shift in monthly rates can translate to thousands saved or spent over the long run. For instance, a 6% loan with monthly compounding ends up pricier than one done annually.

Benefits of Using a Compound Calculator Interest Tool

Diving into a compound calculator interest tool means skipping the headache of tough math and getting spot-on answers right away. Among the perks:

- Experimenting with all sorts of what-ifs, from rates to timelines

- Side-by-side looks at savings accounts, loans, and investment picks

- Really getting how reinvesting amps up growth over time

- Arming yourself with clear info for solid financial calls

Real-Life Applications of a Compound Interest Monthly Calculator

Say you’re aiming for a home down payment, padding your retirement, or funding a kid’s education. A compound interest monthly calculator reveals how steady saving plus interest can balloon into something substantial.

Take this: Stashing $300 monthly at 5% compounded monthly for 15 years lands you over $77,000—way beyond the straight $54,000 you’d contribute.

It really shows how sticking with it, paired with compounding, sparks that explosive growth.

How Compound Interest Shapes Financial Planning

Financial experts often dub compound interest the “eighth wonder of the world” for its game-changing effects. Tools like daily, monthly, or yearly calculators take the guesswork out, letting you plan with solid figures.

Whether it’s plotting retirement or tackling debt, these calculators help you craft choices that match your money dreams.

FAQs on Compound Interest Calculators

Final Thoughts

A compound interest calculator goes beyond being a mere math gadget—it’s a trusted partner in financial planning. From daily compounding options to those Excel tricks, these tools make tricky calculations a breeze and shine a light on your money’s potential path.

Whether you’re stacking up wealth, prepping for retirement, clearing debt, or weighing savings choices, compounding is the engine that speeds things along. By wrapping your head around these calculators and putting them to work, you can start making those sharp money decisions now that pave the way for a brighter financial future.# Your Complete Guide to Smart Growth

Money really starts to build when you invest it thoughtfully, but the true magic in creating wealth comes from the power of compounding. A compound interest calculator stands out as one of the easiest yet incredibly effective tools to visualize just how your savings can multiply as time goes on. No matter if you’re a student dipping your toes into finance basics, a working professional eyeing retirement, or simply someone intrigued by how savings can expand, getting a handle on compound interest is essential.

In this guide, we’ll unpack it all—from figuring out compound interest in Excel to exploring calculators for daily, monthly, weekly, and yearly compounding. You’ll also get insights into tools that factor in withdrawals and various real-world situations, helping you map out your financial path with precision.