Continuous Compound Interest Calculator

Introduction to Continuous Compounding

At the core of growing your money is interest, and compounding is what makes it truly powerful. Most folks are familiar with annual, monthly, or even daily compounding, but continuous compounding is a step beyond—it's the ultimate limit where interest gets added every single moment. This setup delivers the maximum possible growth for an investment or loan, pushing your wealth to its fullest potential.

A Continuous Compound Interest Calculator makes this idea super approachable by crunching the numbers for you instantly with this formula:

A=Pert A = P e^{rt} A=Pert

Where:

- A = The final amount you end up with

- P = Your starting principal

- r = The interest rate (as a decimal)

- t = Time in years

- e = Euler’s number (roughly 2.71828)

It might sound a bit math-heavy at first, but with a good calculator, it’s as easy as pie to understand and use.

Why Continuous Compounding Matters

Compounding is like a snowball effect for your money—interest earns more interest, building your wealth over time. While monthly or daily compounding is what you’ll often see in savings accounts, continuous compounding takes it to the max, giving you the absolute highest growth possible.

For example, let’s say you invest ₹1,00,000 at a 10% interest rate for 5 years:

- With annual compounding, you’d have about ₹1,61,051.

- Monthly compounding bumps it up to around ₹1,64,530.

- Continuous compounding? You’re looking at roughly ₹1,64,872.

The difference might seem modest for short periods, but when you’re dealing with big sums or long timelines, that extra boost from continuous compounding really adds up and can’t be brushed off.

How a Continuous Compound Interest Calculator Works

A continuously compounded interest calculator takes that fancy exponential formula and does all the heavy lifting for you. No need to wrestle with spreadsheets or a scientific calculator—just follow these steps:

- Pop in your principal amount.

- Enter the interest rate.

- Set how many years you’re investing for.

- Boom—the maturity amount appears instantly.

It’s a time-saver, keeps errors at bay, and lets you compare continuous compounding against other methods like daily or monthly.

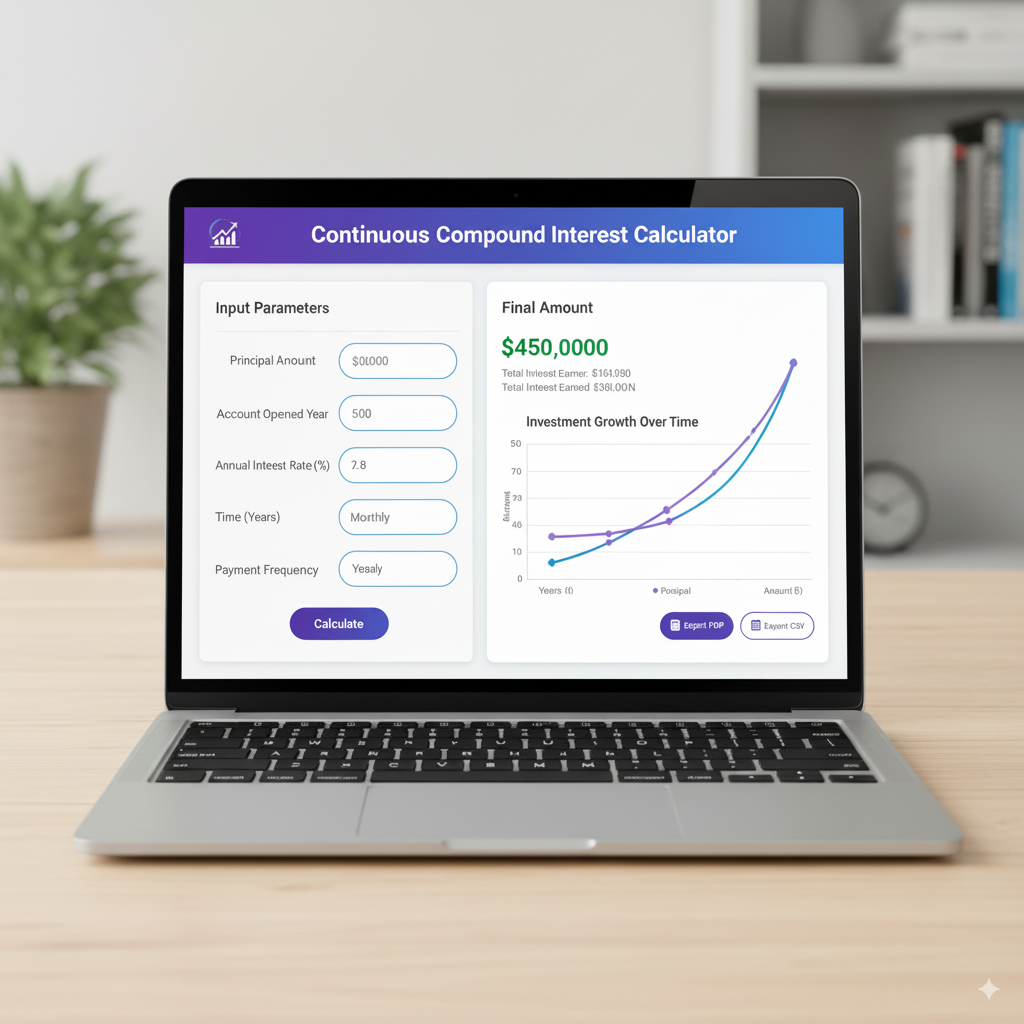

Features of a Good Continuous Compound Interest Calculator

When you’re scouting for an online tool, here’s what makes a great one stand out:

- Easy-to-use interface: Clean fields for principal, rate, and time.

- Instant answers: No waiting or typing out formulas by hand.

- Side-by-side comparison: Some tools let you see continuous versus daily or monthly compounding right there.

- Visual vibe: Growth charts to really show off that exponential curve.

- Downloadable goodies: Options to grab your results as Excel files or PDFs for planning.

Continuous vs Compounded at Intervals

A common question is whether continuous compounding always wins out. It does give you a slight edge in returns, but in the real world, banks and financial folks usually stick to:

- Annual compounding for things like fixed deposits.

- Quarterly or monthly for recurring deposits and loans.

- Daily compounding for stuff like credit card balances.

Continuous compounding is more of a gold-standard benchmark in finance and math, used to gauge the highest possible returns you could theoretically hit.

Using Excel to Calculate Continuous Compounding

Online calculators are awesome, but you can also whip up your own continuous compound interest calculator right in Excel. Just use this formula:

=P∗EXP(r∗t) =P*EXP(r*t) =P∗EXP(r∗t)

For example, if you’ve got ₹50,000 at 12% interest for 3 years, plug in:

=50000∗EXP(0.12∗3) =50000*EXP(0.12*3) =50000∗EXP(0.12∗3)

Excel spits out the maturity value in a snap, no external tools needed. This is a game-changer for folks building financial models or crunching numbers for work.

Application of Continuous Compounding in Real Life

Banks might not use continuous compounding much, but it’s a big deal in high-level finance. Here’s where it shines:

- Pricing derivatives: Things like options and futures rely on continuous compounding for their valuation models.

- Valuing cash flows: It’s used to discount future money in corporate finance.

- Modeling growth: Beyond dollars, it explains stuff like population spikes, decay processes, or other natural trends.

Continuous Compounding vs Daily Compounding

Daily compounding gets close to continuous, but it’s not quite the same. Take ₹10,000 at 8% over 10 years:

- Daily compounding lands you around ₹22,080.

- Continuous compounding? About ₹22,255.

That extra ₹175 might seem small, but scale it up to billions in corporate finance, and it’s a game-changer.

Advantages of a Continuous Compound Interest Calculator

- Spot-on accuracy: No chance of messing up those tricky exponential equations.

- Lightning-fast: Results pop up in seconds.

- Super versatile: Works for both growing investments and tracking loan costs.

- Great for learning: Perfect for students wrapping their heads around exponential growth and logarithms.

Limitations of Continuous Compounding

- Not common in daily banking: You won’t see it for regular deposits or retail loans.

- Risk of over-optimism: Newbies might think these are real-world returns.

- Math-heavy without help: Doing it by hand without a calculator can feel daunting.

Step-by-Step Example Using the Calculator

Let’s walk through a quick example with ₹2,00,000 at 9% yearly interest for 6 years.

Using the formula: A=Pert A = P e^{rt} A=Pert

A=200000∗e0.09∗6 A = 200000 * e^{0.09*6} A=200000∗e0.09∗6

A=200000∗e0.54 A = 200000 * e^{0.54} A=200000∗e0.54

A≈200000∗1.7155 A \approx 200000 * 1.7155 A≈200000∗1.7155

A≈₹3,43,100 A \approx ₹3,43,100 A≈₹3,43,100

So, your investment grows by about ₹1,43,100 with continuous compounding—pretty sweet!

Add to chat

ContinuousCompoundInterestCalculator.js

javascript

Edit in files•Show inline

Creating Your Own Continuous Compound Interest Calculator Online

If you’re a developer looking to craft a web-based calculator, it’s pretty simple with JavaScript or Python. The core logic is just:

A=P∗Math.exp(r∗t) A = P * Math.exp(r * t) A=P∗Math.exp(r∗t)

This lets you build a sleek calculator for a finance blog, website, or app, making it a breeze for users to plug in numbers and see results.

Comparison Table of Different Compounding Types

| Principal | Rate | Time (Years) | Annual | Monthly | Daily | Continuous |

| ₹1,00,000 | 10% | 5 | ₹1,61,051 | ₹1,64,530 | ₹1,64,700 | ₹1,64,872 |

This table shows how continuous compounding consistently edges out the others for max growth.

Role of Continuous Compounding in Academic Learning

For students diving into finance, economics, or math, a continuously compounded interest calculator is a fantastic way to wrap your head around exponential growth. Playing with the numbers helps you see how tiny tweaks in rates or time can spark massive jumps in outcomes.

The Exponential Nature of Growth

Unlike steady, linear growth, continuous compounding is all about that exponential surge—things don’t just grow, they accelerate. A calculator brings this to life with year-by-year plots, making it crystal clear why it’s a big deal for retirement planning, stock analysis, or managing risks in finance.

Continuous Compounding in Cryptocurrencies and Modern Assets

In the world of decentralized finance (DeFi), some platforms toy with near-continuous compounding for staking rewards. It’s not exactly continuous, but the frequent payouts come close, mimicking that exponential vibe. Calculators help users estimate what those gains might look like.

Best Practices for Using a Continuous Compound Interest Calculator

- Double-check the rate: Make sure you convert percentages to decimals (e.g., 10% = 0.10).

- Keep time consistent: Use years, not months, to match the formula.

- Treat it as an estimate: It’s not the exact figure banks will give you.

- Compare for context: Run it alongside daily or monthly compounding to see the full picture.

FAQs on Continuous Compound Interest Calculator

Conclusion

A Continuous Compound Interest Calculator isn’t just a number-cruncher—it’s your window into the world of exponential growth. Whether you’re a student exploring math models, an investor weighing compounding options, or a developer crafting finance tools, this calculator unlocks the full potential of how money can grow over time.