Investment Compound Interest Calculator

Calculate how your investments can grow over time

Introduction

Every investor has that spark of a dream: turning a small stash of savings into a big pile of wealth over time. The secret sauce behind this isn’t just the money you set aside—it’s how it grows through compound interest. Unlike simple interest, which chugs along in a straight line, compounding works its magic by earning interest not just on your original investment but also on the interest it’s already racked up.

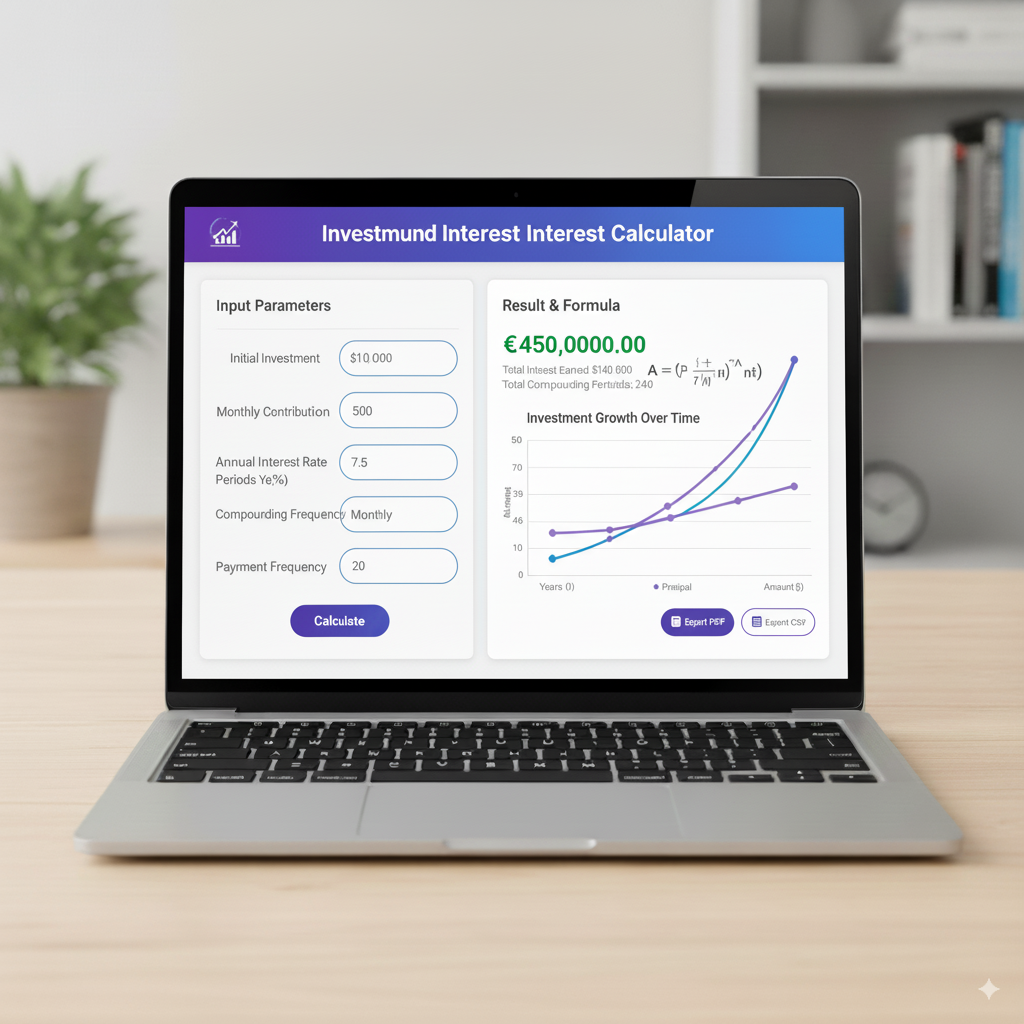

An Investment Compound Interest Calculator brings this dream into focus. Just plug in your starting amount, expected return, how long you’re investing, and how often the interest compounds, and you’ll see exactly how your wealth can snowball. Whether you’re aiming for a cozy retirement, saving for your kids’ education, or chasing financial freedom, this calculator reveals the exponential power of compounding in a way that’s clear, precise, and downright exciting.

What is an Investment Compound Interest Calculator

At its heart, an investment compound interest calculator is a nifty digital tool that uses the compound interest formula to map out your future wealth. Instead of sweating over tricky math with exponents, the calculator does all the heavy lifting, letting you play around with different scenarios in a snap.

Here’s the formula it uses:

A=P(1+rn)nt A = P \left(1 + \frac{r}{n}\right)^{nt} A=P(1+nr)nt

Where:

- A = The final amount you’ll have (principal plus interest)

- P = Your initial investment

- r = The annual rate of return (as a decimal)

- n = How many times interest compounds in a year

- t = The number of years

Just pop in your numbers, and the calculator instantly shows you the results—no math degree required.

Why Compound Interest is the Investor’s Best Friend

Compounding is like a superpower for your money—it’s all about exponential growth. Let’s break it down with a quick comparison:

- Simple Interest: ₹1,00,000 at 10% for 10 years gets you ₹2,00,000.

- Compound Interest: The same investment, compounded annually at 10%, grows to ₹2,59,374.

That’s nearly 30% more, just by letting the interest earn its own interest. The longer you let it run, the more jaw-dropping the effect. A calculator lays this out in seconds, giving you that extra push to stick with long-term investing.

How to Use a Compound Interest Calculator for Investments

Using an investment compound interest calculator is as easy as it gets:

- Enter your starting investment amount.

- Set the annual return rate you expect.

- Pick how often the interest compounds (yearly, quarterly, monthly, or daily).

- Choose how many years you plan to invest.

- Boom—see your maturity value and even a growth chart.

Most calculators let you tweak these inputs over and over, so you can explore all kinds of “what-if” possibilities.

Compounding Frequencies and Their Impact

One big thing a calculator shows is how the frequency of compounding changes the game. The same investment can grow differently depending on how often interest gets added:

- Annually: Once a year.

- Semi-annually: Twice a year.

- Quarterly: Four times a year.

- Monthly: Twelve times a year.

- Daily: A whopping 365 times a year.

The more often it compounds, the bigger your final pile. For long-term goals, the gap between annual and monthly compounding can mean thousands of extra rupees or dollars.

Example Calculation with the Formula

Let’s crunch a real example:

You invest ₹5,00,000 at 8% annual interest, compounded monthly, for 15 years.

Using the formula:

A=500000(1+0.0812)12∗15 A = 500000 \left(1 + \frac{0.08}{12}\right)^{12*15} A=500000(1+120.08)12∗15

A≈500000(1.0067180) A \approx 500000 (1.0067^{180}) A≈500000(1.0067180)

A≈₹15,96,000 A \approx ₹15,96,000 A≈₹15,96,000

With monthly compounding, your money more than triples in 15 years. A calculator does this math in a flash, letting you fine-tune until you hit the perfect plan.

Visual Growth Through Calculators

Numbers in a table can feel dry, but many calculators spice things up with graphs or curves that show your money’s exponential climb. That steep upward swing in later years really hammers home why sticking it out pays off—the longer you invest, the bigger compounding’s impact.

Investment Planning with Compound Interest Calculators

A compound interest calculator investment tool is a game-changer for all kinds of financial goals:

- Retirement Savings: Figure out how much you need to save monthly or as a lump sum to hit your dream retirement fund.

- Children’s Education: See how early investments grow to cover skyrocketing school costs.

- Wealth Building: Compare returns from fixed deposits, mutual funds, or stock market picks.

- Loan Analysis: Understand how compounding pumps up borrowing costs, especially on credit cards or mortgages.

Excel as an Investment Compound Interest Calculator

If you love getting hands-on, Excel can be your personal compound interest calculator with a simple formula:

=P∗(1+(r/n))(n∗t) =P*(1+(r/n))^(n*t) =P∗(1+(r/n))(n∗t)

For example, investing ₹2,00,000 at 12% annual return, compounded quarterly, for 10 years:

=200000∗(1+(0.12/4))(4∗10) =200000*(1+(0.12/4))^(4*10) =200000∗(1+(0.12/4))(4∗10)

Result: Roughly ₹6,23,000.

Excel’s great for modeling multiple scenarios at once, making it a favorite for financial analysts and serious savers.

Continuous Compounding and Advanced Use Cases

Some calculators also offer continuous compounding, where growth happens at every possible moment. The formula is:

A=Pert A = P e^{rt} A=Pert

This isn’t common in regular banking but pops up in things like derivatives pricing or financial engineering. For investors in complex products, this feature gives a clearer picture of potential growth.

Benefits of Using an Investment Compound Interest Calculator

- Saves time: No need to grind through math by hand.

- Pinpoint accuracy: Handles those tricky exponents perfectly.

- Clear results: Easy-to-read outputs with visuals to boot.

- Test away: See how small tweaks in rate or time change your returns.

- Keeps you motivated: Shows the long-term payoff of sticking with it.

Potential Limitations

- Assumes steady returns: Real markets go up and down.

- Misses inflation or taxes: These can nibble away at your actual gains.

- Depends on good inputs: Mess up the numbers, and the output’s off.

Even with these, calculators are still one of the best tools for planning your financial future.

The Psychology of Seeing Compounding in Action

These calculators aren’t just about crunching numbers—they’re motivational gold. When you see how ₹1,000 a month can turn into lakhs or millions, it’s a wake-up call to skip that extra coffee and save instead. It makes long-term goals feel real and reachable.

Case Study: Long-Term Investment Growth

Picture investing ₹10,000 monthly into a fund with a 10% annual return for 25 years. A compound interest investment calculator shows:

- Total contribution: ₹30,00,000

- Final corpus: ~₹1,33,00,000

This proves how consistent saving, juiced up by compounding, builds wealth way beyond what you put in.

Comparing Investment Options with the Calculator

Investors use calculators to stack up different options:

- Fixed Deposits: Lower but steady growth.

- Mutual Funds: Up-and-down but potentially bigger returns.

- Stocks: High risk, high reward over decades.

By tweaking the rate of return, you can balance risk and reward to find what fits your style.

Role of Technology in Financial Literacy

Online investment compound interest calculators have made financial know-how accessible to everyone. Gone are the days when complex math scared people off. Now, anyone can plug in numbers and see their money’s future, empowering smarter choices.

Common Mistakes to Avoid

- Forgetting to switch the interest rate to a decimal (10% = 0.10).

- Mixing up months and years in the time field.

- Not factoring in inflation, which shrinks real money value.

- Assuming sky-high returns that stay constant forever.

Staying mindful keeps your projections grounded.

Future of Investment Calculators

With tech like AI and predictive analytics, future calculators might:

- Simulate market rollercoasters.

- Adjust for inflation automatically.

- Link to your investment accounts for real-time projections.

- Offer tailored advice for your goals.

The next generation will be about smart tools that guide as much as they calculate.

FAQs on Investment Compound Interest Calculator

Conclusion

An Investment Compound Interest Calculator is more than just a tool—it’s a window into your financial future. By simplifying those tricky exponential formulas, it helps investors plan, compare options, and stay committed to their goals.

It shows the value of starting early, staying consistent, and letting time work its magic. Whether you’re tapping an online tool, an Excel sheet, or high-end financial software, understanding compounding ensures you never underestimate its potential. For every investor, the path to wealth isn’t about luck—it’s about patience, discipline, and the unstoppable force of compound interest. A calculator makes that journey crystal clear, turning financial freedom from a dream into a reachable milestone.