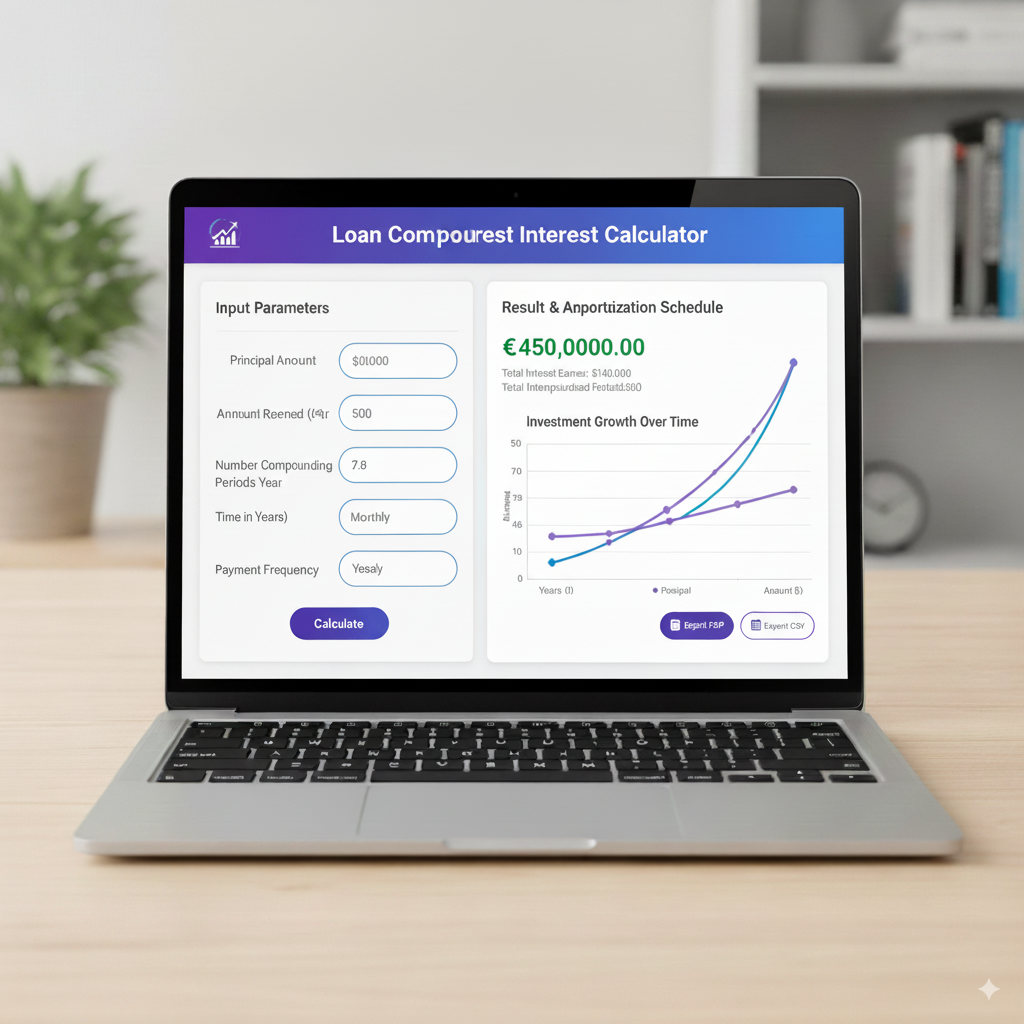

Loan Compound Interest Calculator

Calculate the total cost of a loan with compound interest

Note: This calculator shows the total cost for informational purposes. Actual loan terms may vary.

Introduction

Loans are a big part of life these days—whether it’s for college, a new home, a car, or just bridging a financial gap. The real kicker, though, is the interest, and not all interest works the same way. Simple interest is straightforward, but compound interest? That’s a whole different beast, and it can hit your wallet harder than you might expect.

A Loan Compound Interest Calculator is your secret weapon here. It lays out exactly how much your loan will cost over time by showing how compounding pumps up the amount you owe. With this tool, you can plan your payments, compare loan offers, and avoid getting blindsided by a debt that grows out of control.

What is a Loan Compound Interest Calculator

A Loan Compound Interest Calculator is a handy tool that figures out how your loan balance grows when interest gets added not just to what you borrowed but also to the interest that’s already piled up. Unlike simple interest loans, where the cost stays steady, compound interest loans can snowball fast if you don’t pay them down.

The formula it uses is:

A=P(1+rn)nt A = P \left(1 + \frac{r}{n}\right)^{nt} A=P(1+nr)nt

Where:

- A = The total amount you’ll owe (principal plus interest)

- P = The original loan amount

- r = The annual interest rate (as a decimal)

- n = How many times interest compounds each year

- t = The loan term in years

Plug in your loan details, and the Loan Compound Interest Calculator instantly shows how your debt will grow based on the rate, compounding frequency, and how long you take to pay it off.

Why Compound Interest Matters in Loans

Compound interest is a rock star for growing investments, but when it comes to loans, it’s your adversary. With compounding, you’re not just paying interest on what you borrowed—you’re paying interest on the interest that’s been tacked on, too.

Take this example:

- You borrow ₹1,00,000 at 10% annual interest, compounded monthly.

- After 5 years with no payments, that debt balloons to over ₹1,64,000.

That extra ₹64,000 isn’t just from the original loan—it’s interest piling on top of interest. A Loan Compound Interest Calculator shines a light on this, helping you make smart choices about how fast to repay and which loan terms to pick.

How to Use a Loan Compound Interest Calculator

Most online calculators are a breeze to use. You’ll typically need to input:

- The loan amount you’re borrowing

- The annual interest rate

- How long the loan runs (in years)

- How often interest compounds (yearly, semi-annually, quarterly, monthly, or daily)

- Your repayment plan, if the calculator allows it

Once you hit “calculate,” you’ll get:

- The total loan balance when it’s due

- The total interest you’ll pay

- Cool visuals like charts or tables breaking it all down

This helps you see what’s coming and plan your payments like a pro.

Compounding Frequencies and Loan Impact

How often interest compounds makes a huge difference in what you’ll owe:

- Annual compounding: Interest hits once a year.

- Semi-annual: Twice a year.

- Quarterly: Four times a year.

- Monthly: Twelve times a year.

- Daily: Every single day.

For borrowers, more frequent compounding means a pricier loan. A Loan Compound Interest Calculator shows you clearly how daily compounding can make your debt grow way faster than annual compounding.

Example Calculation – The Real Cost of Compounded Loans

Let’s say you borrow $50,000 at 12% annual interest, compounded monthly, for 10 years.

Using the formula:

A=50000(1+0.1212)12∗10 A = 50000 \left(1 + \frac{0.12}{12}\right)^{12*10} A=50000(1+120.12)12∗10

A≈50000(1.01120) A \approx 50000 (1.01^{120}) A≈50000(1.01120)

A \approx $1,60,000

Your loan more than triples! This shows how brutal compound interest can be if you let it run unchecked. A Loan Compound Interest Calculator crunches this in a second, so you can plan how to tackle it.

Loan Repayments and Compound Interest

Most loans come with regular payments (like monthly installments), but some—like credit cards—let you carry a balance forward. That’s when compounding can really sting.

A Loan Compound Interest Calculator can show you:

- How fast your debt grows if you only make minimum payments

- How much you save by paying extra each month

- How much quicker you’re debt-free if you boost your EMI (Equated Monthly Installment)

This makes it more than just a number-cruncher—it’s a debt-busting sidekick.

Difference Between Loan Compound Interest and Investment Compound Interest

Compounding has two faces:

- For Investments: It’s your best friend, growing your wealth over time.

- For Loans: It’s the villain, inflating what you owe.

Both use the same formula, but the vibe is totally different. An investment calculator gets you excited about growth, while a Loan Compound Interest Calculator sounds the alarm about rising debt. Knowing this helps you balance saving and borrowing wisely.

The Psychology of Debt and Compound Interest

It’s not just about the math—seeing your debt’s future on a calculator can hit you emotionally. When you plug in different repayment plans, it’s like a wake-up call to pay more aggressively, shorten the loan term, and dodge the debt trap. It turns numbers into motivation.

Loan Types That Use Compound Interest

Not every loan compounds the same way. Here’s where you’ll see it:

- Credit Cards: Often compound daily, making them some of the priciest debts out there.

- Mortgages: Usually compounded monthly.

- Personal Loans: Might compound monthly or quarterly, depending on the lender.

- Student Loans: In some places, these rack up compound interest during deferment.

A calculator lets you compare these loan types to pick the least painful option.

Excel as a Compound Interest Loan Calculator

If you like getting hands-on, Excel can be your go-to loan calculator. Use this formula:

=P∗(1+(r/n))(n∗t) =P*(1+(r/n))^(n*t) =P∗(1+(r/n))(n∗t)

For a $25,000 loan at 9% interest, compounded quarterly, over 7 years:

=25000∗(1+(0.09/4))(4∗7) =25000*(1+(0.09/4))^(4*7) =25000∗(1+(0.09/4))(4∗7)

\approx $46,800

Excel also lets you build repayment schedules, EMI tables, and even charts, turning it into a full-on financial planning tool.

Continuous Compounding in Loans

It’s rare in everyday lending, but some products lean on continuous compounding, where interest grows at every possible moment. The formula is:

A=Pert A = P e^{rt} A=Pert

This leads to slightly higher balances than regular compounding, and you’ll see it in things like certain payday loans or credit facilities—pricey stuff! A calculator can model this to show just how costly it gets.

Benefits of a Loan Compound Interest Calculator

- Clear picture: Shows exactly how your debt will grow.

- Payment planning: Spots savings from paying more or sooner.

- Comparison tool: Helps you weigh different loan offers.

- Debt prevention: Warns you off risky borrowing choices.

- Learning boost: Makes you savvier about how loans work.

Limitations of Loan Compound Interest Calculators

- Fixed-rate assumption: Real-world rates can shift.

- Hidden costs: Fees, penalties, or taxes might not show up.

- Payment flexibility: Basic calculators might not handle custom repayment plans.

Even so, these tools are still a borrower’s best friend for planning.

Case Study – Mortgage with Compounding

Picture a $200,000 home loan at 6% annual interest, compounded monthly, for 30 years.

Using a compound interest calculator:

A=200000(1+0.0612)12∗30 A = 200000 \left(1 + \frac{0.06}{12}\right)^{12*30} A=200000(1+120.06)12∗30

\approx $1,15,74,000

That’s almost six times the original loan if you let it compound without payments! Mortgages usually involve monthly EMIs, but this shows why paying on time matters so much.

Avoiding the Debt Spiral – Lessons from Calculators

Lots of folks fall into debt traps because they don’t see compounding coming. A calculator helps you:

- Spot the cost of delaying payments.

- Plan extra payments to save thousands.

- Compare how shorter loan terms cut down on compounding pain.

It’s all about awareness—knowledge is your shield against runaway debt.

Modern Tech and Loan Calculators

Today’s calculators are more than just number-crunchers. With mobile apps and AI, they can:

- Ping you with repayment reminders.

- Suggest the best payment amounts.

- Show interest savings from early payoffs.

- Adjust for real-time rate changes.

This tech keeps the power of planning right in your pocket.

Common Mistakes Borrowers Make Without a Calculator

- Ignoring compounding when shopping for loans.

- Thinking the lowest monthly payment is always the best deal.

- Not realizing longer terms mean more compounding.

- Missing how daily compounding (like on credit cards) adds up fast.

A calculator clears up these mix-ups in a heartbeat.

The Future of Loan Analysis

Loan calculators are getting smarter. Soon, they might:

- Pull your loan data straight from your bank.

- Map out custom repayment plans in real time.

- Factor in market changes for more accurate projections.

The future is about tools that don’t just calculate—they guide you to financial freedom.

FAQs on Loan Compound Interest Calculator

Conclusion

A Loan Compound Interest Calculator is more than just a tool—it’s a wake-up call. It shows the real cost of borrowing, helping you make smarter choices to keep debt in check. Instead of being caught off guard, you can see exactly how your loan grows and plan ways to tackle it head-on.

Compounding can be your ally or your enemy. In savings, it builds wealth; in loans, it piles on debt. The choice isn’t whether compounding happens—it always does—it’s how you handle it. Using a compound interest calculator for loans ensures you borrow smart, pay wisely, and keep your financial future secure. It turns hidden numbers into clear truths, giving you control and peace of mind for the road ahead.