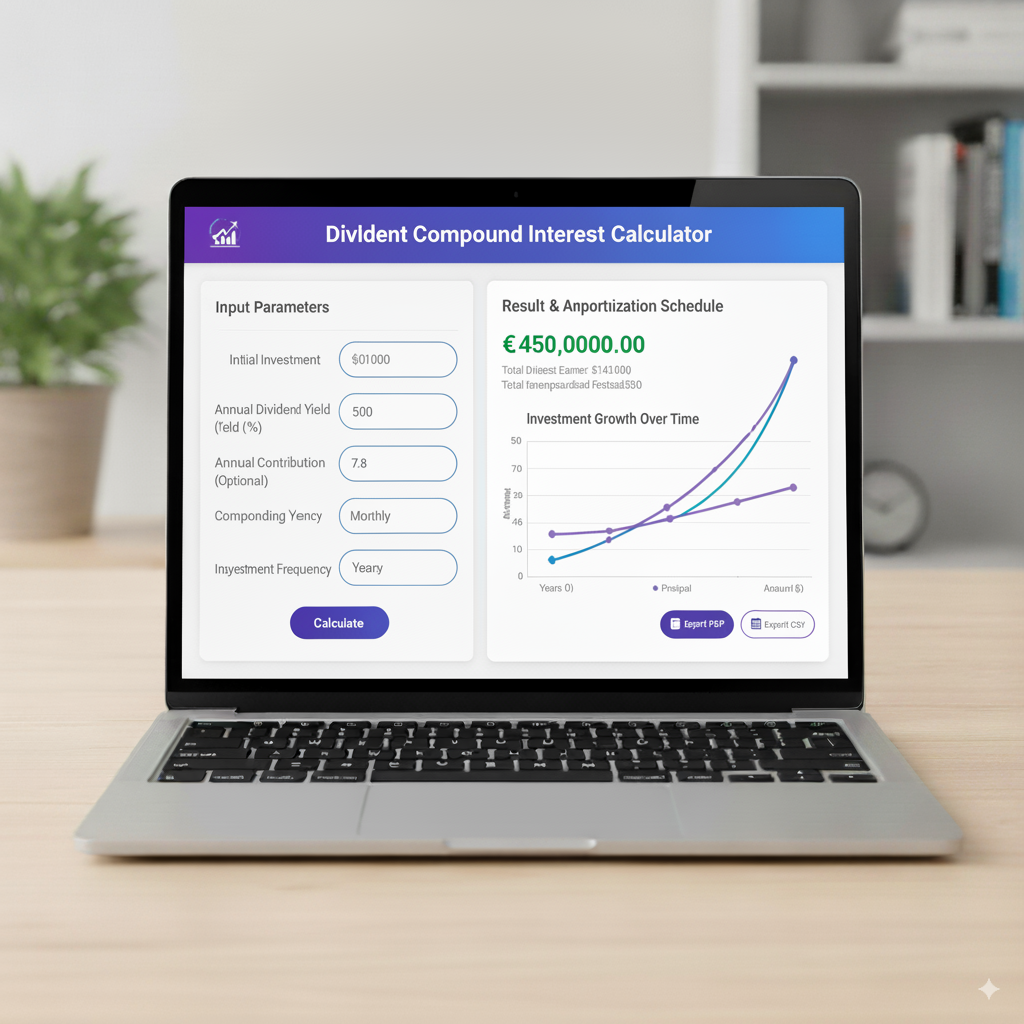

Dividend Compound Interest Calculator

Calculate how dividend reinvestment can grow your portfolio

Annual Dividend Income

Introduction to Dividend Growth and Compounding

When it comes to building wealth that lasts, two words steal the show: dividends and compounding. Dividends are those sweet cash payouts companies share with their investors from their profits. Compounding? That’s the magic of reinvesting those dividends so your money starts earning returns on both your original investment and the dividends you’ve tucked back in.

A Dividend Compound Interest Calculator is your ticket to seeing this magic in action. Just pop in a few details—like how much you’re investing, the expected return, and your reinvestment plan—and you can watch your wealth snowball over years or even decades. It’s a game-changer for anyone looking to grow their money smartly.

Understanding Dividend Compounding

The Power of Reinvestment

Unlike interest from a savings account, dividends give you a choice: take the cash or reinvest it to buy more shares. When you reinvest, you’re stacking the deck—those new shares start earning dividends of their own, kicking off a cycle of exponential growth.

Picture this: you own 100 shares of a company paying $2 per share annually. That’s $200 in your pocket. Reinvest that $200 to buy more shares, and next year, you’re earning dividends on a bigger pile. A calculator makes this growth easy to see and plan for.

Dividends vs. Interest: Why Calculators Differ

Regular interest calculators assume steady rates and predictable growth, like a savings account. Dividend calculators, though, have to juggle reinvested dividends, shifting share prices, and yearly dividend increases. That’s why a dividend compounding calculator is a bit more dynamic than your standard bank interest tool.

How a Dividend Compound Interest Calculator Works

Key Inputs Required

Most calculators ask you to enter:

- Initial investment: The cash you’re starting with.

- Annual contribution: Any extra money you plan to add regularly.

- Dividend yield: The percentage of the share price paid out as dividends.

- Dividend growth rate: How much you expect the dividend payouts to grow each year.

- Time horizon: How many years you’ll keep reinvesting.

Plug in these details, and the calculator paints a picture of how your portfolio could grow under different scenarios.

Formula Behind the Scenes

The basic compounding formula is:

Future Value=P×(1+rn)n×t \text{Future Value} = P \times \left(1 + \frac{r}{n}\right)^{n \times t} Future Value=P×(1+nr)n×t

Where:

- P = Your starting investment

- r = The rate of return (including dividends)

- n = How many times it compounds per year

- t = Total years

For dividend stocks, the formula tweaks to account for reinvested dividends and growth rates, which is why you need a specialized calculator to get it right.

Benefits of Using a Dividend Compounding Calculator

Clarity on Long-Term Growth

It’s easy to brush off small dividends, but a calculator shows how they add up. That $5,000 investment? It could grow into six figures over a few decades, and seeing those numbers makes the potential feel real.

Smarter Financial Planning

With a clear projection, you can set goals for retirement or passive income. Want to know how much your dividends could cover in 20 years? The calculator lays it out, helping you decide if you need to invest more or tweak your strategy.

Comparison Across Stocks

Not all dividend stocks are equal. A calculator lets you pit two companies against each other—say, one with a high yield but slow growth versus one with a lower yield but faster-growing dividends. You’ll see which one builds more wealth over time.

Using Excel for Dividend Compound Calculations

If you’re a spreadsheet nerd, Excel is perfect for building your own Dividend Compound Interest Calculator. You can customize it to track your actual dividend income and tweak assumptions as you go.

- Use the FV (Future Value) formula to project compounded returns.

- Add rows for annual dividend yield and reinvestment.

- Throw in charts to watch your dividend income climb over the years.

Online calculators are quick, but Excel gives you flexibility and full control.

Dividend Compound Interest in Different Timeframes

Daily Compounding with Dividends

Companies don’t usually pay dividends daily, but if you reinvest dividends right away, you can mimic daily compounding. A calculator can show how this immediate reinvestment juices up your returns.

Monthly Dividend Growth Calculations

Some stocks, like REITs (Real Estate Investment Trusts), pay dividends monthly. A monthly dividend compounding calculator shows how these frequent payouts speed up growth compared to quarterly ones.

Annual Compounding Perspective

For stocks with quarterly or annual dividends, yearly compounding gives you a solid big-picture view. These calculators focus on long-term growth rather than day-to-day swings, perfect for planning decades out.

Dividend Compounding vs. Simple Dividend Income

If you pocket your dividends as cash, your income stays flat. For example, a $1,000 investment at a 5% yield pays $50 a year, every year. But reinvest that $50, and you’re soon earning $52, then $55, and so on. Over decades, the difference is massive. A calculator drives this home, showing why reinvesting is such a powerhouse move.

Factors Affecting Dividend Compounding Projections

Dividend Yield Variability

Dividends aren’t set in stone. Companies might boost payouts, cut them in tough times, or even pause them. A good calculator lets you tweak the yield to match real-world possibilities.

Stock Price Fluctuations

When you reinvest dividends, you buy shares at whatever the market price is. If prices dip, you snag more shares, which can boost your income later. Calculators that factor in price changes give you a more realistic outlook.

Dividend Growth Rate

Some companies, like “dividend aristocrats,” raise their dividends every year. Plugging in a 5–10% growth rate can seriously pump up your compounding projections.

Practical Applications of Dividend Compounding Calculators

Retirement Planning

If you’re aiming for financial freedom, these calculators show how your dividend income could grow to cover your living expenses. Test different contribution levels to see when you might hit your goal.

Long-Term Wealth Creation

Parents can use calculators to see how reinvesting dividends could fund big milestones, like a kid’s college tuition. A 20–30 year horizon makes compounding a total rock star.

Investment Strategy Adjustments

If your projections fall short, you can tweak your plan—maybe add more cash, pick higher-yield stocks, or stretch your timeline. The calculator helps you find the right balance.

Comparing Dividend Calculators with Other Investment Tools

Unlike standard compound interest calculators, dividend-specific ones weave in growth rates and reinvestment. Compared to loan or savings calculators, they’re trickier but way better for stock investors. They bridge the gap between textbook math and real-world investing.

Common Mistakes When Using Dividend Compound Interest Calculators

- Overly rosy growth: Assuming dividends will always climb at high rates.

- Forgetting taxes: Dividends are often taxed, which cuts into what you can reinvest.

- Ignoring inflation: Your projections should account for what your money will really buy.

- Overlooking risk: Companies can slash dividends out of the blue.

Steer clear of these traps, and your calculator becomes a trusty guide, not just a daydream machine.

Future of Dividend Compounding Tools

With AI and fintech on the rise, future calculators might pull live stock market data, adjust for dividend announcements on the fly, and give real-time projections. Mobile apps are already making dividend compounding easier for newbies, putting wealth-building in everyone’s hands.

FAQs on Dividend Compound Interest Calculator

Conclusion

A Dividend Compound Interest Calculator isn’t just a fancy gadget—it’s your roadmap to financial growth. By showing how reinvesting dividends can snowball your wealth, it helps you make smart choices, set realistic goals, and tap into the true power of compounding. Whether you’re using a quick online tool or a custom Excel setup, the key is staying consistent: reinvest those dividends, stay patient, and let time work its magic.