Compound Interest Formula Calculator

Introduction

They call compound interest the “eighth wonder of the world” for a reason—it can turn modest savings into serious wealth if you give it time. But to tap into that magic, you need to get the math right. That’s where a Compound Interest Formula Calculator steps in to save the day.

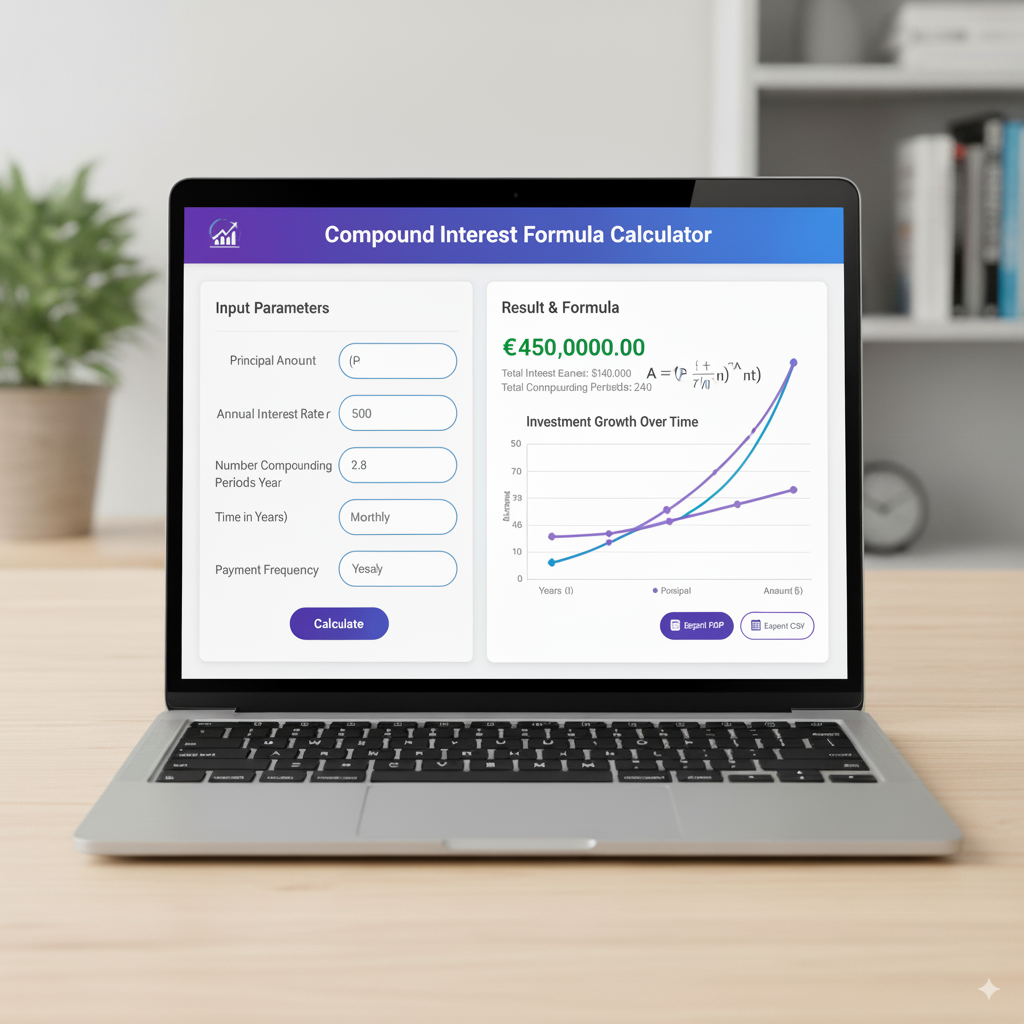

Instead of wrestling with pen-and-paper calculations or fiddling with spreadsheets, this tool lets you plug in your starting amount, interest rate, how often it compounds, and how long you’re investing for, then instantly shows you the results. Whether you’re dreaming of a comfy retirement, figuring out loan repayments, or planning your next investment move, a compound interest formula calculator brings clarity, precision, and speed to the table.

This guide breaks down the formula, walks through real-life examples, and shows how these calculators help everyone from investors to students to everyday savers.

What is Compound Interest?

Compound interest is like a snowball rolling downhill—it picks up speed and size as it goes. Unlike simple interest, which only earns on your initial deposit, compound interest lets the interest you earn start making its own interest, creating exponential growth.

Here’s a quick example:

- With simple interest, ₹1,00,000 at 10% for 5 years gives you ₹50,000 in interest.

- With compound interest, that same amount at the same rate and time grows to ₹1,61,051, netting you ₹61,051 in total interest.

The gap might seem small at first, but over decades, it’s a game-changer. That’s why investors rave about the power of compounding.

The Compound Interest Formula Explained

At the heart of it all is this formula:

A=P(1+rn)nt A = P \left(1 + \frac{r}{n}\right)^{nt} A=P(1+nr)nt

Where:

- A = The final amount (principal plus interest)

- P = Your starting principal

- r = The annual interest rate (as a decimal)

- n = How many times interest compounds in a year

- t = The number of years

This formula is the engine inside every compound interest formula calculator. By automating the math, online tools deliver quick, error-free results that make planning a breeze.

Why Use a Compound Interest Formula Calculator

Doing the math by hand for different scenarios can be a slog. A calculator makes it effortless:

- You toss in your numbers.

- It crunches the formula and spits out accurate results.

- You can play around with variables like how often it compounds or how long you’re in for.

This is a lifesaver for planning your finances, understanding how your money grows, and sizing up different investment options.

Breaking Down Compounding Frequencies

Compounding doesn’t always happen just once a year. Depending on your bank or investment, it might go:

- Annually: Once a year.

- Semi-Annually: Twice a year.

- Quarterly: Four times a year.

- Monthly: Twelve times a year.

- Daily: A whopping 365 times a year.

The more often interest compounds, the bigger your final amount. A compound interest formula calculator shows you instantly how these frequencies shift the outcome.

Step-by-Step Example Using the Formula

Let’s walk through a quick calculation:

Principal = ₹2,00,000

Rate = 8% (0.08)

Compounding = Quarterly (4 times a year)

Time = 5 years

Using the formula:

A=200000(1+0.084)4∗5 A = 200000 \left(1 + \frac{0.08}{4}\right)^{4*5} A=200000(1+40.08)4∗5

A=200000(1+0.02)20 A = 200000 (1 + 0.02)^{20} A=200000(1+0.02)20

A=200000(1.0220) A = 200000 (1.02^{20}) A=200000(1.0220)

A≈₹2,97,600 A \approx ₹2,97,600 A≈₹2,97,600

So, in 5 years, your money grows by about ₹97,600. With a calculator, this takes just a second to figure out.

Visualizing Compounding with a Calculator

Modern calculators often come with cool visuals like charts or growth curves. These make it super clear how exponential growth outpaces straight-line growth. For students, seeing that curve shoot upward over the years really drives home why compound interest is such a big deal.

Compound Interest Formula in Excel

If you’re a spreadsheet fan, Excel can double as your compound interest formula calculator. Use this formula:

=P∗(1+(r/n))(n∗t) =P*(1+(r/n))^(n*t) =P∗(1+(r/n))(n∗t)

For example, if you invest ₹1,50,000 at 12% for 10 years with annual compounding:

=150000∗(1+0.12/1)(1∗10) =150000*(1+0.12/1)^(1*10) =150000∗(1+0.12/1)(1∗10)

Result = ₹4,66,095

Excel lets you model tons of scenarios at once, which is perfect for pros or anyone who loves digging into the numbers.

Continuous Compounding Formula

Some fancy calculators also handle continuous compounding, where interest is added at every possible moment. The formula for that is:

A=Pert A = P e^{rt} A=Pert

For ₹1,00,000 at 9% over 10 years:

A=100000∗e0.09∗10 A = 100000 * e^{0.09*10} A=100000∗e0.09∗10

A≈₹2,45,960 A \approx ₹2,45,960 A≈₹2,45,960

You won’t see this much in everyday banking, but it’s a staple in advanced financial modeling.

Practical Uses of a Compound Interest Formula Calculator

Retirement Planning

A calculator shows how steady contributions, compounded over decades, can build a hefty nest egg.

Loan Analysis

Borrowers can see how compounding jacks up loan repayments, especially with frequent compounding.

Education Savings

Parents planning for kids’ schooling can figure out exactly how much to set aside each month.

Wealth Management

Investors use calculators to compare mutual funds, fixed deposits, or recurring deposit growth side by side.

Advantages of Using a Compound Interest Calculator

- Saves you time: No need to slog through manual math.

- Boosts accuracy: Exponents are tricky, and calculators nail them every time.

- Lets you test scenarios: Tweak numbers to see different outcomes fast.

- Smarter choices: Helps you pick the best investment path.

Limitations to Keep in Mind

- Real-world returns vary: Inflation and taxes can eat into your gains.

- Not always realistic: Some calculators assume steady rates, but markets wiggle.

- Garbage in, garbage out: Wrong inputs lead to wonky results.

How Investors Use the Calculator for Long-Term Growth

Investors love using a compound interest formula calculator to play out scenarios like:

- What happens if I bump up my contributions by 10% each year?

- How much does monthly compounding help over 30 years?

- What rate do I need to double my money in 12 years?

These insights steer you toward sharper financial decisions.

The Psychology of Compounding

It’s not just about numbers—calculators can spark motivation. When you see how small, regular savings can balloon into something huge, it pushes you to keep at it. It turns abstract money talk into real, tangible goals.

Advanced Features in Modern Calculators

Some tools go way beyond the basics with:

- Currency switches for global investors.

- Inflation-adjusted projections.

- SIP (Systematic Investment Plan) options.

- Charts comparing multiple investment paths.

These make calculators super handy for both newbies and pros.

Compound Interest Formula in Education

Teachers lean on calculators to show off exponential growth in action. By tweaking time or rates, students can see how math applies to real money decisions. It’s a staple in finance and business classes.

Case Study: Small Savings, Big Growth

Imagine a student stashing ₹5,000 monthly into a fund at 10% annual return for 20 years. A compound interest calculator reveals:

- Total invested = ₹12,00,000

- Final corpus ≈ ₹38,00,000

This shows just how powerful steady saving plus compounding can be.

Comparing Simple vs Compound Interest Using a Calculator

Run the same numbers through a calculator for simple versus compound interest, and you’ll see compound always comes out ahead. For beginners, this side-by-side view really hammers home the difference.

Real-Life Benefits for Borrowers and Lenders

Banks and lenders use the compound interest formula to craft their products. Meanwhile, borrowers can use calculators to grasp how interest piles up on loans, mortgages, or credit cards. For example, daily compounding on a credit card can make balances spiral faster than you’d expect—a calculator lays that bare.

The Role of Technology in Compounding Calculations

Back in the day, analysts leaned on tables or hand calculations. Now, we’ve got smartphone apps, web-based calculators, and even tie-ins with personal finance tools. This makes financial know-how accessible to everyone.

Common Mistakes People Make in Compound Interest Calculations

- Forgetting to turn the interest rate into a decimal (10% = 0.10).

- Mixing up months and years in the time field.

- Ignoring the compounding frequency when entering numbers.

A calculator sidesteps these slip-ups.

Future of Compound Interest Tools

With AI and predictive tech on the rise, future calculators might:

- Model market ups and downs.

- Automatically adjust for inflation.

- Sync with your investment accounts for live projections.

The next wave will be smart tools tailored to your specific goals.

FAQs on Compound Interest Formula Calculator

Conclusion

A Compound Interest Formula Calculator is more than just a number-cruncher—it’s your ticket to financial clarity. By tapping into a simple but powerful exponential formula, it shows how your money can grow with time, discipline, and consistency.

For investors, it sharpens decisions. For students, it brings math to life. For borrowers, it exposes the true cost of debt. And for savers, it fuels the habit of steady investing. Whether you’re using an online tool, Excel, or pro-level software, mastering this calculator lets you plan, compare, and make choices with confidence. The real secret to wealth isn’t just earning—it’s letting compounding work its magic, and a calculator makes sure you never miss that spark.