MoneyChimp Compound Interest Calculator

See how your investments can grow over time

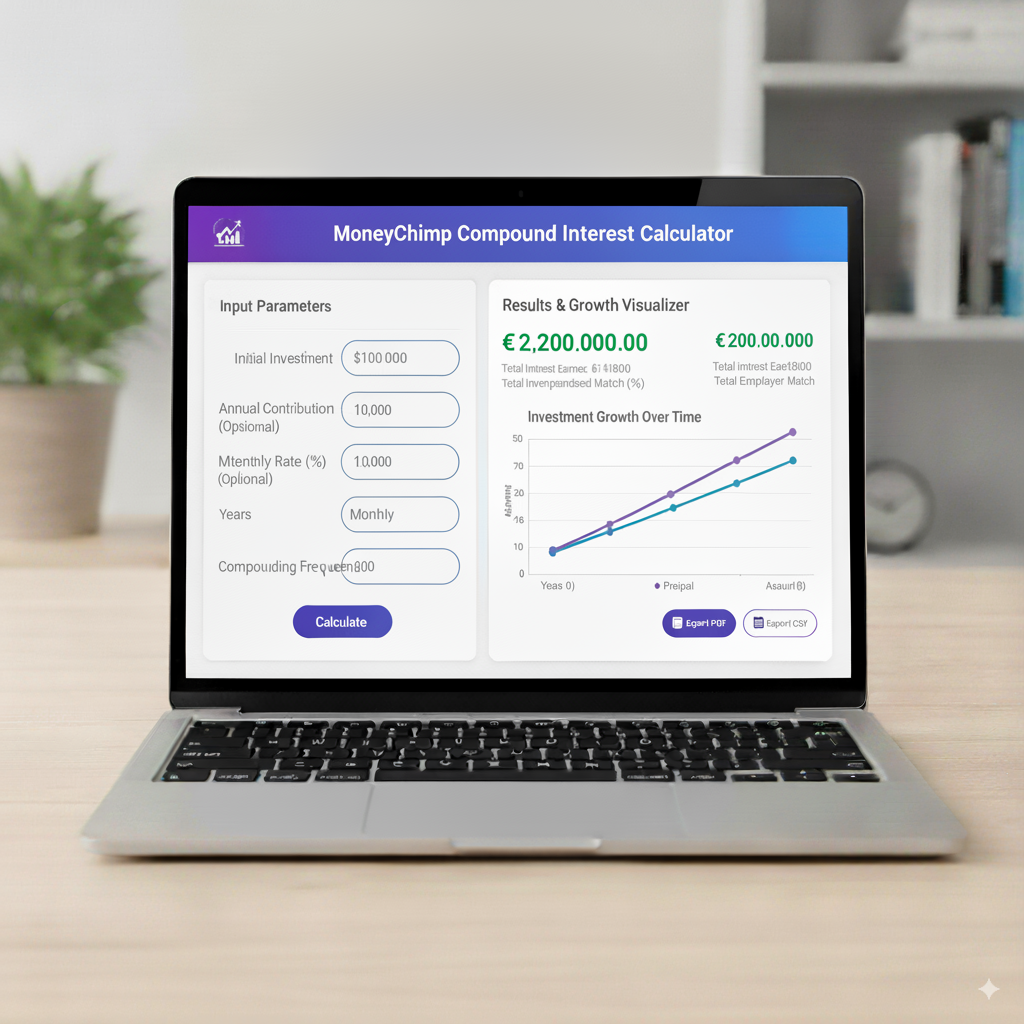

If you’ve ever searched for “compound interest” and felt your brain start to shut down at all those formulas, MoneyChimp compound interest calculator is the kind of tool that pulls you back from the edge. It’s straightforward, no-nonsense, and made for folks who just want to see how their money can grow over time with some basic inputs like contributions and rates. This guide breaks down what the MoneyChimp Compound Interest Calculator is all about, how it stacks up against other popular ones, how to whip up something similar in Excel, scenarios you should try right away, and the heads-ups every saver needs to keep in mind.

Whether you’re mapping out a savings target, figuring retirement contributions, or explaining to a teenager why starting now beats waiting, this piece turns the geeky stuff into real-life steps you can take today.

What the MoneyChimp Compound Interest Calculator Is and Why It’s Useful

The MoneyChimp compound interest calculator is a straightforward online tool that calculates your future value based on a starting amount, regular additions, an assumed growth rate, and the duration you choose. It keeps things basic on purpose: no over-the-top features, just the essential math to give you quick, reliable answers. If you’re after year-by-year breakdowns or easy “what-if” tests, this is the tool that delivers without forcing you to dive into a finance manual first.

Here’s why something like MoneyChimp’s is a winner:

- You skip the formula memorization and get straight to results.

- It breaks down principal versus interest earned, so you can spot how much compounding really chips in.

- It’s perfect for quick checks or teaching moments, like “If I tuck away X each month, will I hit Y by my goal date?”

Other MoneyChimp Compound Interest Calculator pile on extras like inflation tweaks or risk simulations, but MoneyChimp’s simplicity is its secret sauce—clear answers without the distractions.

The Core Compound Interest Formula MoneyChimp Uses – Explained Simply

All compound interest calculators run on the same basic math. The go-to formula for growth with regular additions is:

Future Value = Starting Principal × (1 + r)^t + Periodic Contribution × [((1 + r)^t − 1) / r]

Where r is your growth rate per period (annual if you’re thinking yearly), and t is the number of periods (like years). MoneyChimp makes this easy by letting you enter the details in a clean setup, so you don’t have to battle exponents yourself. If you’re curious about continuous compounding, that’s a twist with e^(rt), but for everyday savings or investments, annual or monthly discrete compounding is what you’ll see in action.

The beauty? Input your principal, toss in contributions, pick a rate, and let time handle the rest. That’s compounding, stripped down.

How MoneyChimp Compares to Other Popular Calculators (Investor.gov, Bankrate, Calculator.net)

Compound interest tools fall into a few buckets:

- Minimalist ones (like MoneyChimp): Quick, transparent, and focused on the basics—great for learning or fast checks.

- Loaded-up versions (Bankrate, NerdWallet): They add compounding options, recurring deposits, inflation fixes, and even export tools.

- Learning-focused (Investor.gov): Mobile-friendly with guides that teach as much as they calculate, more about understanding than heavy planning.

MoneyChimp hits that sweet spot between education and utility—simple for beginners but solid for real projections. If you crave Monte Carlo risk runs or tax details, you’ll outgrow it eventually, but for most day-to-day planning, it’s a reliable starting line.

Inputs to Test – What to Tweak and Why

Fire up the MoneyChimp calculator (or any similar one), and zero in on these inputs—they’re the levers that move the needle:

- Starting Principal: Your seed money that kicks off the compounding—small starts can still build momentum with time.

- Annual Addition or Periodic Contributions: These are the steady drips that fuel most real growth.

- Growth Rate Assumption: Your yearly return guess—keep it grounded and try a few variations.

- Years to Grow: Time is the secret sauce; more years mean way more compounding power.

- Compounding Frequency: If it lets you switch between monthly and annual, give both a spin—monthly edges out a bit.

Pro move: Kick off with a baseline using your best real numbers, then run a downbeat and upbeat version. That range beats pinning hopes on one sunny projection.

How to Interpret the Output – What MoneyChimp (and Calculators Generally) Will Show You

Expect to see:

- The final future value.

- Total contributions versus total interest earned.

- Year-by-year balances (often in a handy table).

- CAGR or implied yearly return for double-checking.

Zero in on the contributions versus earnings split. It’s eye-opening how much of that end balance comes from compounding rather than your pocket—that “aha” moment often lights a fire to save harder.

Practical Scenarios You Should Plug In Right Now

Give these a whirl to feel the power firsthand:

- Small Start, Long Haul: $1,000 to begin, $50 monthly, 7% return, 30 years. See how steady drips turn into a real pile.

- Late Bloomer, Big Push: $10,000 start, $1,000 monthly, 7% return, 20 years. Watch how ramping up makes up ground.

- No Adds, High Returns: $10,000 start, $0 monthly, 10% return, 30 years—pure compounding in action.

- Inflation Reality Check: Same setup but factor in 3% inflation (if the tool allows; MoneyChimp nudges you to think real versus nominal).

These quick runs build gut feel: time trumps all, and habits beat waiting for a windfall.

Building a MoneyChimp Compound Interest Calculator in Excel

Craving an offline version you can mess with? Recreating MoneyChimp in Excel is a snap.

Set up columns: Year, Starting Balance, Contribution, Growth (rate × starting + contribution), Ending Balance. Year 0 gets your starting balance. For each row, figure growth, then ending = starting + contribution + growth. Drag down for your years.

Or grab Excel’s FV function for a one-cell wonder with lump-sum plus annuity:

=FV(rate,nper,−pmt,−pv,0) =FV(rate, nper, -pmt, -pv, 0) =FV(rate,nper,−pmt,−pv,0)

- rate = Annual rate (convert to monthly if needed)

- nper = Number of periods

- pmt = Periodic payment (negative)

- pv = Present value (negative)

This nails the final value fast. Build the year-by-year table for charts—they make the growth pop and keep you hooked.

Why Frequency of Contributions and Compounding Matters – A Little Nuance

Folks often blur contribution frequency (monthly, yearly) and compounding frequency. Contributing monthly but modeling yearly compounding undersells things a tad—earlier deposits grow longer. More frequent compounding (monthly over annual) bumps results slightly. The gap’s tiny short-term but stacks up over decades. Match your frequencies for the truest picture.

Common Mistakes Users Make and How to Avoid Them

- Dreamy Returns: Historical averages aren’t set in stone—stick to a cautious baseline.

- Fee Blind Spot: Expense ratios compound against you. Always subtract a fee guess from your return.

- Inflation Oversight: Big numbers on paper can shrink in real life.

- Promise Trap: Outputs are estimates, not crystal balls—markets wiggle.

Go for ranges and aim for the middle or low end to stay grounded.

How Calculators Handle Dividend Reinvestment, Splits, and Other Stock Nuances

MoneyChimp and similar tools often use a simple total-return model—you enter an average growth rate that folds in dividends. For deep dividend reinvestment (DRIPs), you want a tool that splits price growth and yield, or models per-period buys. If dividends drive your strategy, pick a calculator that handles payouts and reinvestment explicitly. For broad planning, a single return rate works fine for most folks.

Comparing MoneyChimp Output to Real-World Accounts (Savings, Brokerage, Retirement)

Savings accounts or CDs compound at low, steady rates—input the APY, and you’ll get a spot-on match. For brokerage or retirement accounts, returns and ups-and-downs vary more. MoneyChimp shines for quick mental models, like “What if I put $300 monthly in a balanced fund at 6%?” For tax-heavy planning, export to a spreadsheet and tweak, but MoneyChimp sets the foundation.

Using MoneyChimp for Teaching – Why It Works in Classrooms and with Teens

MoneyChimp’s clean setup is a teacher’s dream. For teens or newbies, its simple inputs let you demo the Rule of 72, doubling time, or the gap between starting at 20 versus 35. A growth chart or year-by-year table (pulled from outputs) seals the deal—seeing it beats explaining it.

Limitations to Be Aware Of – What MoneyChimp Intentionally Does Not Do

- No Tax Crunching: For after-tax views, export and adjust elsewhere.

- No Monte Carlo: It’s straight-line projections, not risk bands.

- Basic Features Only: No inflation auto-adjust, variable contributions, or fee breakdowns. For those, level up to fancier tools.

That “less is more” vibe keeps it approachable—use it as your launchpad, then add layers as needed.

How to Validate Results and Cross-Check for Errors

Test the same setup in two or three tools (MoneyChimp, Calculator.net, Investor.gov). Big differences? Hunt for mismatches in units (annual vs. monthly), timing (start vs. end of period), or defaults like fees or inflation. Spot the culprit, and you’re golden.

Practical Checklist for Using MoneyChimp Like a Pro

- Kick off with your real balances and doable contributions.

- Pick a grounded baseline return, then test low and high versions.

- Tweak fees and inflation manually if the tool doesn’t.

- Copy year-by-year results to Excel for charts and notes.

- Revisit yearly to track and adjust as life shifts.

FAQs – Focused Answers About MoneyChimp Compound Interest Calculator

What is the MoneyChimp Compound Interest Calculator and how is it different from other calculators

MoneyChimp’s is a clean, basic tool that figures future value from your starting amount, regular adds, a growth rate, and time span. It’s built for quick insights and learning, not fancy tax or risk modeling like some others.

How should I choose the growth rate input in MoneyChimp

Go conservative with real-world averages—4–8% nominal for a mixed portfolio, then test lower and higher. The tool models what you enter, so your assumptions drive the results.

Can MoneyChimp model monthly contributions and monthly compounding accurately

Yes—if you tweak the annual rate to monthly (divide by 12 or convert properly), it handles monthly deposits and compounding well. Match your input frequency to the tool’s setup for the best accuracy.

Does MoneyChimp account for inflation and taxes automatically

Nope—it sticks to nominal projections. For real buying power or after-tax views, subtract inflation or taxes from your returns or export to a spreadsheet for adjustments.

What’s the simplest way to teach a teen compound interest using MoneyChimp

Plug in a 30–40 year run with a tiny monthly deposit and pull up the growth chart. Highlight time and steady saving over exact rates—its easy layout keeps things fun and clear.

If I want probability-based outcomes (Monte Carlo), what should I use instead of MoneyChimp

Step up to retirement planners with Monte Carlo built in. MoneyChimp gives straight projections for your rates but skips the thousands-of-paths risk view.

How much difference does compounding frequency make in long-term results

It’s a nudge—monthly beats annual slightly for the same rate, and the gap grows over decades. Match your contribution timing to compounding for the sharpest picture.

Is MoneyChimp reliable for initial financial planning

Totally—for baselines and getting the basics right, it’s spot-on and simple. For deeper dives (tax tweaks, safe withdrawals, or risk spreads), use it as a jumping-off point for more specialized tools.

Final Thoughts – Use MoneyChimp Compound Interest Calculator to Set a Baseline,

MoneyChimp’s compound interest calculator is that perfect “just get started” tool: quick, clear, and great for building intuition. It’s ideal for learning the ropes, testing fast ideas, and sparking decisions like upping your auto-save rate. Once you’ve got the basics down, layer on inflation, taxes, fees, or Monte Carlo for the full picture. The real win? Turning those insights into habits: automate your savings, snag any employer match, and check back yearly. Compounding thrives on time and steadiness—MoneyChimp helps you see the path there.