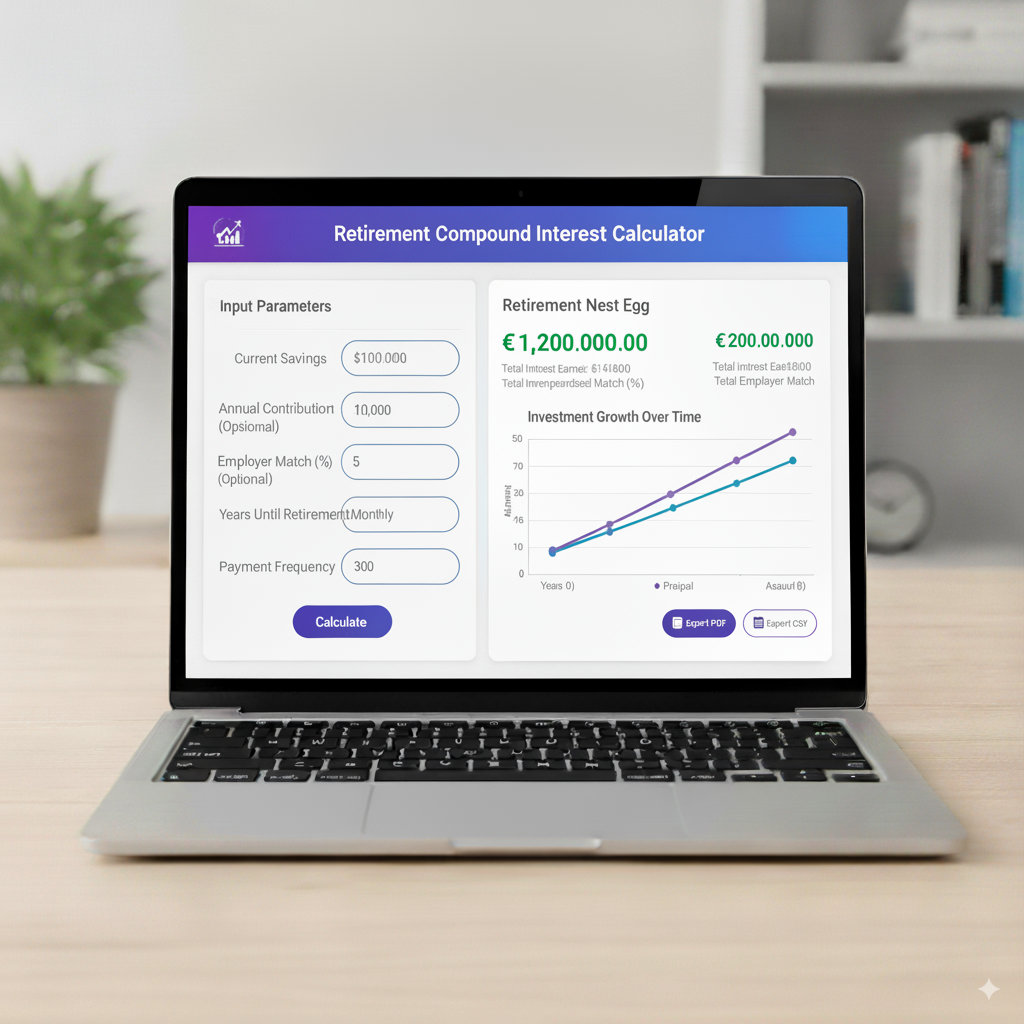

Retirement Compound Interest Calculator

Plan your retirement savings with compound growth

Retirement Readiness

*Based on a 4% safe withdrawal rate

Planning retirement feels like a weird mix of math, dreams, and low-key anxiety. The one thing that actually helps is clarity: numbers that show where you stand and what you need to do. A Retirement Compound Interest Calculator does exactly that — it’s your financial telescope. Feed it your savings, contributions, expected return, and time horizon, and it projects how compounding will shape your nest egg.

This guide walks you through everything: the formulas behind the calculators, realistic inputs to use, how compounding interacts with contributions and withdrawals, Excel templates, advanced features like Monte Carlo simulation, real-life scenarios, and practical tips to make compounding work for you. No fluff — just useful, human advice.

What a retirement compound interest calculator actually does

At its core, the calculator projects future value. It answers questions like: If I save $X today and add $Y each month at an expected return of Z% for N years, how big will my retirement account be? But it does more than just spit out a number. Good Retirement Compound Interest Calculator show:

- The breakdown between principal (what you put in) and earnings (what compounding produced).

- Year-by-year balances so you see the trajectory, not just the end.

- Sensitivity to changes in contribution, rate, fees, and inflation.

- Sometimes the ability to test withdrawal strategies so you can see if your money lasts.

Think of it as a sandbox where you test “what if” scenarios until the future feels manageable.

The math behind the magic: simple formulas explained

There are two baseline formulas you’ll see in calculators:

- Future value of a lump sum (no extra contributions)

A = P × (1 + r/n)^(n×t)

Where A is the future value, P is the principal now, r is annual return (decimal), n is number of compounding periods per year, and t is time in years. - Future value with regular contributions (annuity)

When you add periodic contributions (like monthly savings), the formula becomes a bit longer. For contributions at the end of each period:

FV = P × (1 + r/n)^(n×t) + PMT × [((1 + r/n)^(n×t) − 1) / (r/n)]

PMT is the periodic contribution amount (per compounding period). Excel’s FV function implements these calculations so you rarely have to do the algebra by hand.

If a calculator offers continuous compounding or advanced modeling, it may also use the continuous formula A = P × e^(r×t). That’s the theoretical maximum growth and useful for comparison, but practically most retirement plans assume annual or monthly compounding.

Inputs that make your projection realistic (and why each matters)

Fake inputs yield fake comfort. Use realistic numbers for these key fields:

Current balance

This is your current retirement savings. If you have multiple accounts, either run them together or roll them into a single starting number for the model.

Contribution amount and frequency

Are you contributing monthly, per paycheck, or annually? Small differences in frequency matter — depositing earlier in each period gives compounding more time to work.

Employer match and taxes

If your workplace matches contributions, include that — it’s free money. Also note whether contributions are pre-tax (traditional) or after-tax (Roth), because taxes change the after-withdrawal outcome.

Expected rate of return (nominal)

This is the hardest one: choose conservatively. For a diversified equity-heavy portfolio, many planners use 6–8% nominal as a baseline. Bond-heavy portfolios deserve much lower assumptions. If your calculator allows, run multiple scenarios (pessimistic, baseline, optimistic).

Inflation rate

Nominal returns are before inflation. For purchasing-power projections, use a realistic inflation assumption (commonly 2–3% historically in many economies) to compute real returns.

Fees and expense ratios

Small fees compound against you. Subtracting an annual fee (0.5–1%) from your expected return gives a more accurate net projection.

Time horizon

How many years until retirement? Longer horizons heavily favor compounding because returns build on each other.

Withdrawal strategy (post-retirement)

If your calculator offers withdrawal modeling, specify the withdrawal rate, frequency, and whether withdrawals increase with inflation. That helps confirm whether your nest egg is sustainable.

Compounding frequency: monthly, daily, continuous — what to choose

Compounding frequency nudges the result. Annual compounding is the simplest, but many accounts effectively compound monthly (via monthly contributions or monthly returns). The general rule: more frequent compounding yields slightly higher results. For realistic retirement planning:

- Use monthly compounding if contributions are monthly or per paycheck.

- Use annual if you want a simpler model and are not sensitive to small differences.

- Ignore continuous compounding for standard retirement accounts — it’s theoretical and rarely used in practice.

The difference between monthly and annual compounding is small over short periods but can matter over decades.

Employer match and catch-up contributions: turbocharging the math

If you get an employer match in a defined contribution plan like a 401(k), always model it. A match is immediate, risk-free return that compounds from day one. For example, a 50% match on your contribution up to 6% of salary is basically an instant 50% return on that part of your savings — rare and powerful.

Catch-up contributions matter for people age 50+. They allow you to contribute more each year and massively increase late-career compounding. If your calculator supports age-based input, toggle a higher contribution at the age where catch-up applies.

Modeling different retirement accounts: Roth vs Traditional vs taxable

A retirement compound interest calculator should let you choose tax handling:

- Traditional (pre-tax): Your contributions reduce taxable income now, but withdrawals in retirement are taxed as ordinary income. Project the gross growth and then model tax at withdrawal based on expected retirement tax rate.

- Roth (after-tax): You pay taxes up front but qualified distributions are tax-free. The projection is more straightforward: the entire projected balance is usually tax-free upon qualified withdrawal.

- Taxable brokerage: Dividends and capital gains are taxed as they occur (or upon sale). This requires modeling long-term capital gains and dividend taxes; many calculators let you estimate an effective tax drag.

After-tax outcomes are what actually pay your bills in retirement. For realistic planning, compare Roth vs Traditional net-of-tax projections.

Excel guide: build your own retirement compound interest calculator

If you want a reusable tool, create an Excel sheet with year-by-year rows. Here’s a lean way to set it up:

Columns: Year, Starting Balance, Contribution, Employer Match, Gross Return, Fees/Taxes, Ending Balance

- Starting Balance of Year 1 = current balance.

- Contribution = annual total (or calculate from monthly/payscale).

- Employer Match = formula based on contribution and match policy.

- Gross Return = (Starting Balance + Contribution + Match) × expected annual return.

- Fees/Taxes = (Starting Balance + Contribution + Match) × fee rate and estimated tax drag (for taxable accounts).

- Ending Balance = Starting Balance + Contribution + Match + Gross Return − Fees/Taxes.

- Next year Starting Balance = previous Ending Balance.

- Repeat for N years.

Use absolute references for rates so you can drag formulas easily. At the end, create a table showing total contributions vs total earnings, CAGR validation, and a chart of the balance over time.

This gives flexibility: you can add variable contributions over years, change rates mid-model, and add withdrawals at the end.

Beyond averages: Monte Carlo simulation and scenario testing

Average returns are convenient, but they hide variability. Monte Carlo simulation runs thousands of possible return sequences (using expected return and volatility) and produces a probability distribution of outcomes. That helps answer questions like: What’s the chance my portfolio will reach $X by retirement? Or, what’s the risk of running out of money under a given withdrawal plan?

Monte Carlo is hugely useful for understanding risk. If your Retirement Compound Interest Calculator supports it, use it to see median outcomes, and the 10th and 90th percentiles. If not, run three deterministic scenarios (pessimistic, baseline, optimistic) with different rates — it’s less precise than Monte Carlo, but still informative.

Sequence-of-returns risk: why timing of returns matters more than you think

Compound interest rewards positive returns, but sequence matters when you withdraw. If the market tanks early in retirement while you’re making withdrawals, the portfolio can be damaged permanently — even if long-term average returns are fine. Retirement Compound Interest Calculator that model withdrawals or simulate sequences help you visualize this risk.

Strategies to mitigate sequence-of-returns risk include maintaining a cash reserve, gradually shifting to lower-volatility assets before retirement, or using annuities for a guaranteed income floor.

Withdrawal strategies and safe withdrawal rates

Calculators often let you simulate withdrawal strategies. The classic rule of thumb is the 4% rule: withdraw 4% of the initial retirement balance adjusted for inflation each year. That historically offered a high probability of not running out over a 30-year retirement in some markets, but it’s not guaranteed and depends on market conditions, fees, taxes, and personal risk tolerance.

More modern approaches use dynamic withdrawal rules (adjust up/down based on portfolio performance), or blend guaranteed income (annuities, pensions) with portfolio withdrawals.

Test different withdrawal rates in your calculator to see how sensitive your plan is. Even small changes (from 4% to 3.5% or 4.5%) have big impacts on longevity of funds.

Practical examples: three realistic retirement scenarios

Scenario A — The Early Starter

You start at 25 with $10,000, save $500 per month, expect a 7% average annual return, and plan to retire at 65. The compounding of regular contributions plus the long horizon leads to a large final balance. Time is the magic multiplier here.

Scenario B — The Late Catch-Up

You start at 45 with $50,000, save aggressively $1,200 per month, use catch-up contributions at 50, and retire at 67. Higher contributions partially offset the lost time. The calculator shows that while starting late is harder, disciplined savings plus higher returns can still produce respectable outcomes.

Scenario C — Conservative Near-Retiree

At 60, you have $600,000 and plan to retire at 66. Your allocation is conservative, expecting 4% returns. You want to test if a 3.5–4.0% withdrawal rate is sustainable. A Retirement Compound Interest Calculator with withdrawal modeling helps determine safe spending levels and whether a portion should be annuitized.

Each scenario demonstrates how contributions, returns, time, and withdrawal choices combine — the calculator turns guesswork into measurable strategy.

Fees, taxes, and inflation: the silent compounding eroders

Compounding works for returns but against fees and taxes. An annual 1% fee reduces net returns and compounds into a meaningful drag over decades. Similarly, taxation on withdrawals or dividends reduces real spending power. Always use net-of-fee assumptions to understand realistic outcomes.

Inflation reduces purchasing power. For example, a balance that looks huge nominally could buy much less if inflation is high. Use inflation-adjusted (real) projections when planning retirement lifestyle.

Behavioral aspects: using the calculator to build better habits

A retirement compound interest calculator doesn’t just inform — it motivates. When people see how much an extra 1% contribution today changes outcomes decades later, they’re more likely to increase savings. Use the calculator as a behavioral tool: set incremental savings goals, automate increases (e.g., auto-enroll increases on raises), and use visual charts to maintain discipline.

Common mistakes people make when using calculators

- Using unrealistically high return assumptions.

- Ignoring fees, taxes, and inflation.

- Forgetting to include employer match or social security/pension income.

- Treating average return as a guaranteed return.

- Not modeling withdrawals or sequence-of-returns risk.

Avoid these and your retirement plan will be far more robust.

How to validate and trust a calculator’s output

Validate your model by running a few test cases with known outcomes (for example, a lump sum growth with no contributions should match the simple formula). Cross-check with at least one other reputable calculator and ensure the units match (monthly vs annual inputs). If you build in Excel, include sanity checks (total contributions sum, CAGR calculation, etc.).

Actionable tips to maximize compound interest for retirement

Start now: even small contributions compound surprisingly well over decades.

Capture employer match: it’s free money and multiplies compounding.

Automate increases: auto-escalation features increase savings without relying on willpower.

Keep fees low: prefer low-cost index funds inside retirement accounts.

Diversify and rebalance: reduce unnecessary risk without sabotaging long-term returns.

Plan withdrawals: test withdrawal strategies in your calculator before retirement.

FAQs — tailored for Retirement Compound Interest Calculator users

Closing thoughts — compound interest won’t do everything, but it’s your best friend

Compound interest doesn’t guarantee a worry-free retirement, but used wisely it’s the most dependable engine for building wealth. The real work is not mystical math; it’s consistent saving, sensible asset allocation, keeping costs low, and planning withdrawals thoughtfully. A Retirement Compound Interest Calculator turns the abstract into a plan: use it to set specific goals, run scenarios, and track progress. Start now, tweak often, and keep your eyes on the long-term prize — compounding loves time and discipline.