Savings Compound Interest Calculator

See how your savings can grow with compound interest

Your future self will thank you for saving today!

Introduction

Who doesn’t dream of watching their savings grow without sweating over every investment decision? The real magic behind building wealth over time isn’t luck—it’s compound interest. By letting your earnings earn more earnings, your money can grow way faster than you might expect. A Savings Compound Interest Calculator is your go-to tool to see exactly how your savings can stack up, factoring in your deposits, interest rates, and how often the interest compounds.

Whether you’re stashing cash for retirement, your kid’s college fund, or just a rainy-day buffer, understanding how compound interest works—and how to calculate it—can completely change the way you think about your money.

What is a Savings Compound Interest Calculator

A compound interest savings calculator is a handy digital tool that shows you how much your money will grow when interest gets added not just to your initial deposit but also to the interest you’ve already earned. Unlike simple interest, which sticks to just the starting amount, compounding gives your savings a turbo boost.

Here’s the formula most calculators use:

A=P(1+rn)nt A = P \left(1 + \frac{r}{n}\right)^{nt} A=P(1+nr)nt

Where:

- A = Your final savings amount

- P = The initial amount you put in

- r = The annual interest rate (as a decimal)

- n = How many times interest compounds each year

- t = How many years you’re saving for

This formula makes sure both your original deposit and the interest it earns keep growing, leading to some seriously impressive growth over time.

Why Compounding is Called the “Eighth Wonder of the World”

There’s a reason people say Albert Einstein called compound interest the eighth wonder of the world—it rewards those who wait. Even small, steady savings can balloon into something huge if you give it enough time to compound.

Check this out:

- You deposit $10,000 at 7% interest, compounded annually.

- After 10 years: ~$19,671

- After 20 years: ~$38,696

- After 30 years: ~$76,122

A savings compound interest calculator puts this growth front and center, showing you that time is your biggest ally when it comes to building wealth.

How to Use the Savings Compound Interest Calculator

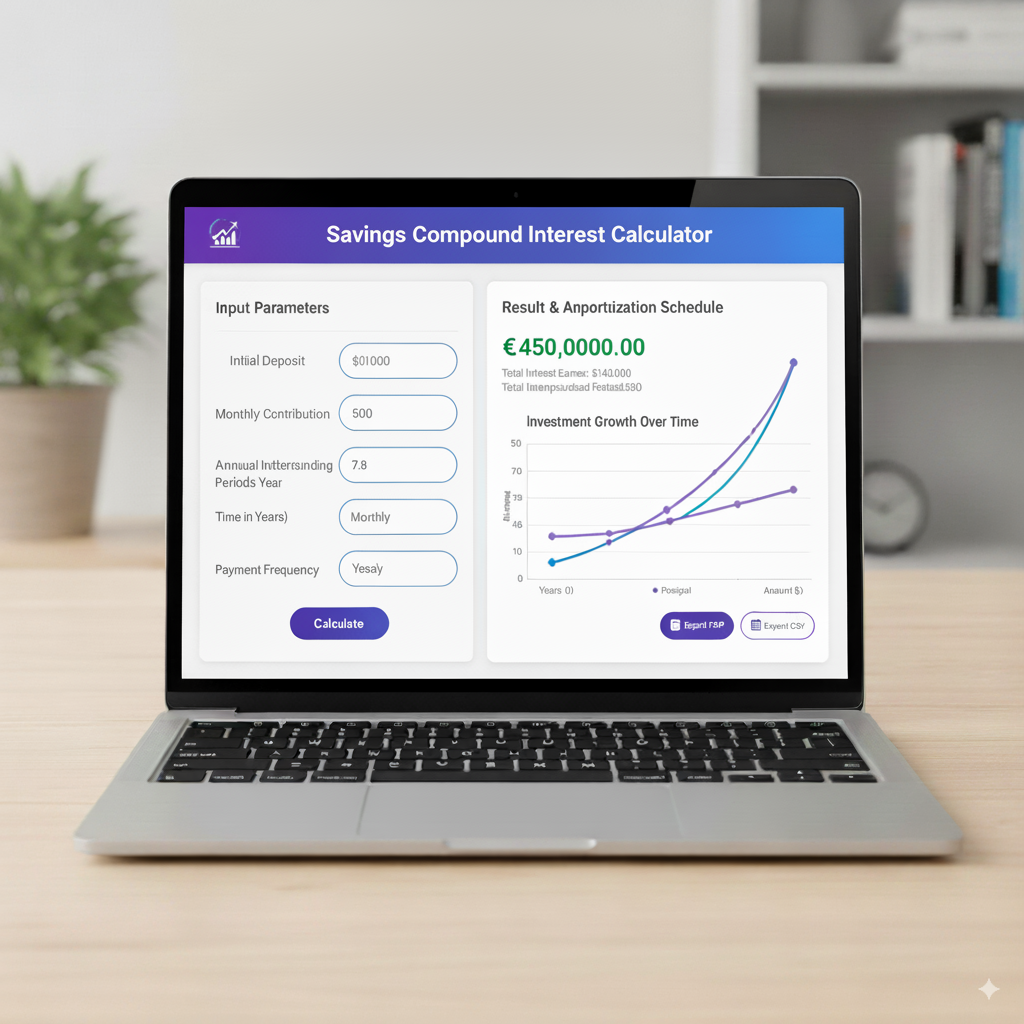

Using a calculator is a breeze, but getting the inputs right is key. You’ll typically need to enter:

- Initial Deposit: The starting amount you’re saving.

- Annual Contribution (if you want): Any extra deposits you plan to add regularly.

- Interest Rate: The annual return from your savings account or investment.

- Compounding Frequency: Yearly, semi-annual, quarterly, monthly, weekly, or daily.

- Time Period: How long you’ll let your money grow.

Once you plug these in, the calculator shows you:

- Your total savings down the road

- The interest you’ve earned separate from your deposits

- Cool visuals like growth charts or tables to make it all crystal clear

Compounding Frequencies in Savings

How often interest compounds can make a big difference in your savings growth:

- Annual Compounding: Interest gets added once a year.

- Semi-Annual: Twice a year—gives a slight boost.

- Quarterly: Four times a year.

- Monthly: Added every month, common for savings accounts.

- Daily: Compounded every day for max growth.

The more often it compounds, the bigger your final balance. A savings compound interest calculator lets you test different frequencies to see how they stack up.

Example: Power of Compounding in Savings

Picture saving $5,000 at 5% annual interest for 15 years:

- Annual Compounding: $10,386

- Monthly Compounding: $10,568

- Daily Compounding: $10,582

The differences might look small year to year, but over decades, they really add up. The calculator makes it easy to see these comparisons in a snap.

Add to chat

SavingsCompoundInterestCalculator.js

javascript

Edit in files•Show inline

Benefits of Using a Savings Compound Interest Calculator

- Clear financial goals: See exactly how much you’ll have down the line.

- Boosts regular saving: Shows how steady deposits supercharge growth.

- Compares options: Test different banks, accounts, or rates side by side.

- Fires you up: Seeing big future numbers keeps you motivated to save.

- Retirement planning made easy: Accurately forecasts decades of savings growth.

Why Simple Interest Falls Short for Savings

With simple interest, you only earn on your original deposit, so growth stays flat. Compound interest, though, lets you earn on both your deposit and the interest it’s racked up, creating a snowball effect.

For example:

- Simple Interest on $10,000 at 6% for 10 years = $6,000 interest.

- Compound Interest at the same rate and time = ~$7,908 interest.

The gap gets wider the longer you save. A calculator shows why compounding is the way to go for growing wealth.

Using Excel as a Compound Interest Savings Calculator

If spreadsheets are your thing, Excel can be your personal savings calculator. Use this formula:

=P∗(1+(r/n))(n∗t) =P*(1+(r/n))^(n*t) =P∗(1+(r/n))(n∗t)

You can also set up tables for different years, rates, or compounding periods and add charts to see your savings grow visually. It’s like an online calculator but with more room to customize.

Visualizing Growth with Charts and Tables

The best part of a compound interest savings calculator is seeing your money grow not just as numbers but as graphs or charts. A line curving upward over the years makes the power of compounding feel real. Many calculators also give you yearly balance tables, which can be a huge motivator to keep saving.

Short-Term vs Long-Term Savings with Compounding

- Short-Term (1–5 years): Compounding’s effect is small but still useful for emergency funds.

- Long-Term (10–30+ years): This is where compounding really shines, turning modest savings into serious wealth. Perfect for retirement or education goals.

A calculator lets you compare both scenarios side by side.

Real-Life Applications of a Savings Compound Interest Calculator

- Emergency Funds: See how your safety net grows in a high-yield savings account.

- Retirement Accounts: Estimate the growth of your 401(k) or pension.

- College Savings: Figure out how today’s deposits cover tomorrow’s tuition.

- Wealth Building: Compare savings accounts, fixed deposits, or mutual funds.

Playing with different rates and timeframes gives you practical insights for smart money moves.

Daily Savings and Compounding Impact

Don’t sleep on small, daily savings. Stashing just $5 a day at 8% interest, compounded monthly, for 30 years adds up to nearly $204,000. A calculator lets you test these micro-saving habits, showing that consistency trumps big, one-off deposits.

The Role of Interest Rates in Compounding Savings

Even tiny differences in interest rates can make a huge impact over time.

For example:

- $50,000 for 20 years at 5% = ~$132,665

- At 6% = ~$160,356

- At 7% = ~$193,484

This is why using a calculator to compare savings accounts or investments is a must.

Inflation and Compound Savings

Calculators can show impressive growth, but inflation matters. If your account earns 6% but inflation’s at 3%, your real growth is closer to 3%. Some advanced calculators let you factor in inflation for a more realistic picture.

Limitations of Savings Compound Interest Calculators

- They assume a steady interest rate, which isn’t always the case.

- Real returns can vary due to inflation, market shifts, or fees.

- Taxes on interest earned might not be included unless you specify.

Even with these quirks, they’re still super reliable for planning.

Psychological Benefits of Visualizing Savings

Seeing your money’s future value can be a game-changer. When you plug numbers into a calculator, those big, far-off goals start feeling real. This can help you skip impulsive purchases and stick to smarter financial habits.

Modern Tools vs Traditional Calculations

Back in the day, you’d need a calculator or a financial advisor to figure out savings growth. Now, online tools and mobile apps let you track your progress in real time and tweak your plan on the go, making it easier than ever to stay on top of your savings.

Tips for Maximizing Compound Interest Savings

- Start early: More time means more compounding magic.

- Save regularly: Even small amounts add up.

- Pick frequent compounding: Monthly or daily beats yearly.

- Keep earnings in: Don’t pull out interest—let it grow.

- Shop for rates: Compare accounts to find the best interest rate.

Testing these strategies in a calculator shows just how powerful they can be.

Case Study – Retirement Savings Example

Imagine saving $200 a month at 8% interest, compounded monthly:

- After 10 years: ~$36,000

- After 20 years: ~$118,000

- After 30 years: ~$295,000

This shows how steady saving and compounding can lead to life-changing results. Without a calculator, it’s easy to underestimate this kind of growth.

The Future of Savings Calculators

As AI and fintech keep evolving, savings calculators are getting sharper. Soon, they might:

- Link directly to your bank account for real-time updates.

- Adjust for inflation automatically.

- Suggest the best savings plans for you.

- Compare other financial products on the spot.

These upgrades will keep your financial planning clear and easy.

FAQs on Savings Compound Interest Calculator

Conclusion

A Savings Compound Interest Calculator isn’t just about crunching numbers—it’s about seeing what your money can become. By showing how your deposits grow exponentially over time, it turns vague financial dreams into solid plans. Whether you’re saving for a short-term goal or long-term security, understanding compounding gives you the power to make smarter choices.

The truth is, money grows when you give it time. Compounding is patient, steady, and incredibly powerful. With a good savings strategy and a trusty calculator, you can unlock financial freedom, one compounded dollar at a time.